CERF Blog

A brief update of a blog of about a month ago regarding banking:

The FDIC reports that 83 banks have been closed so far this year. While there were 140 bank failures in 2009, we are on track (based on a simple extrapolation of current trends) to experience at least 160 bank failures in 2010. This is down from my month-ago extrapolation of 180 failures.

These failures are occurring while the Fed is paying interest on excess reserves, which has the effect of removing or tightening credit in the banking system. One would think that in this recessionary environment the Fed would implement a credit relaxing policy rather than a credit tightening policy. Rather, the Fed is pursuing this policy because there are a lot of banks out there that they are worried about.

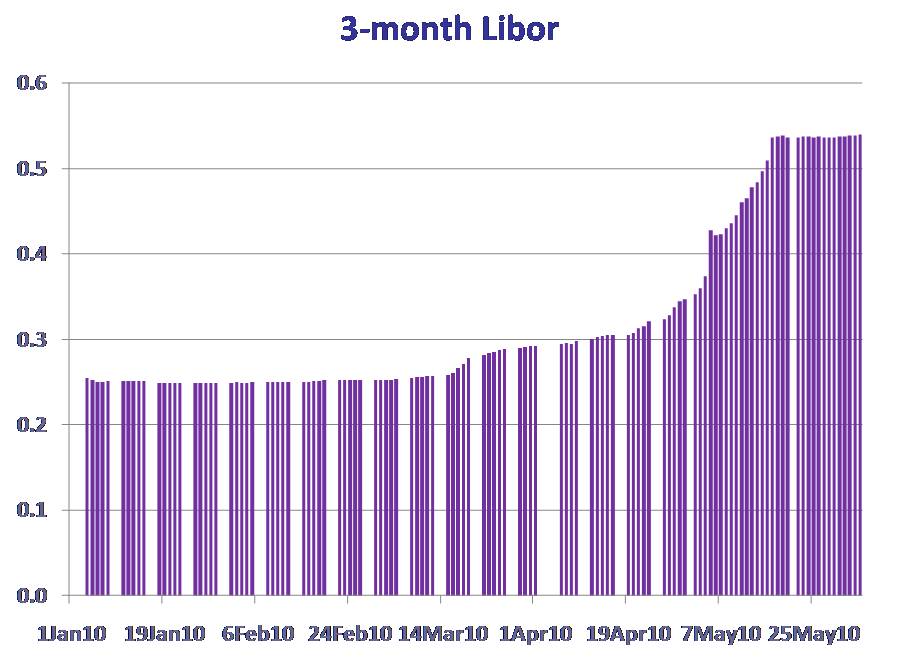

The three month Libor rate has remained high, indicating that banks remain worried about the credit worthiness of various institutions around the world. See the chart below.