CERF Blog

Molly Clancy & Dan Hamilton

In July we discussed the topic of Multiple-Equilibria in the United States economy. This blog is an update to that post, which can be found here. We argued there that the United States is currently in a “good-deflation” equilibrium, where consumers and producers find low price growth as helpful in cutting costs in a balance-sheet rebuilding environment and the Fed finds low-inflation growth as helpful in maintaining historically low interest rates without worrying about rapid inflation.

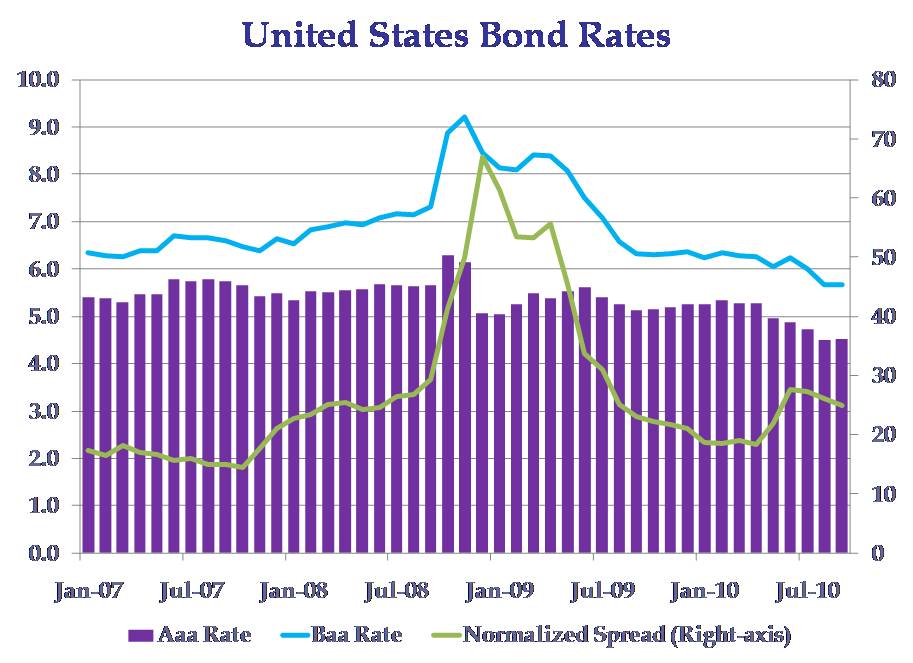

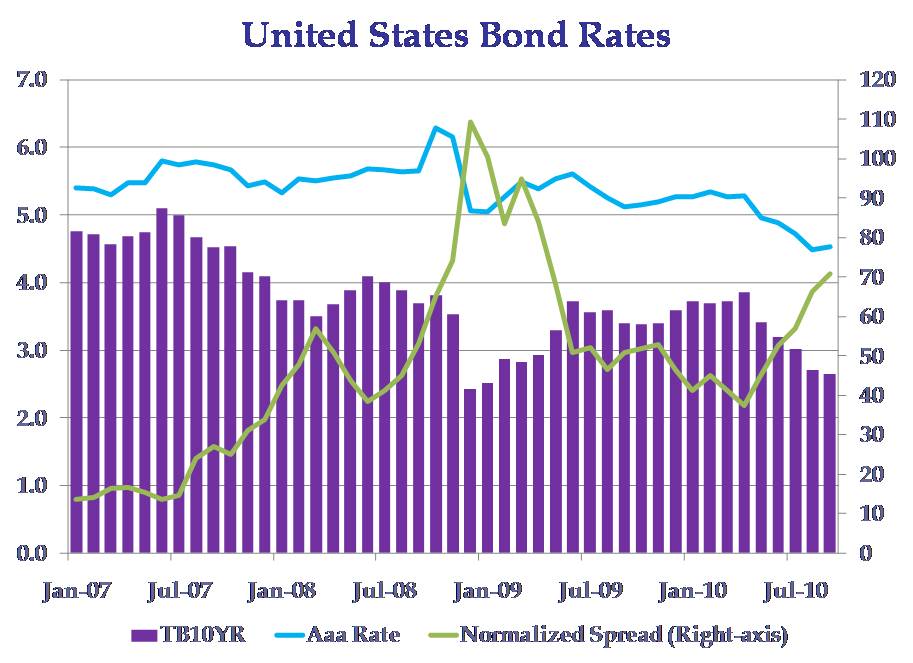

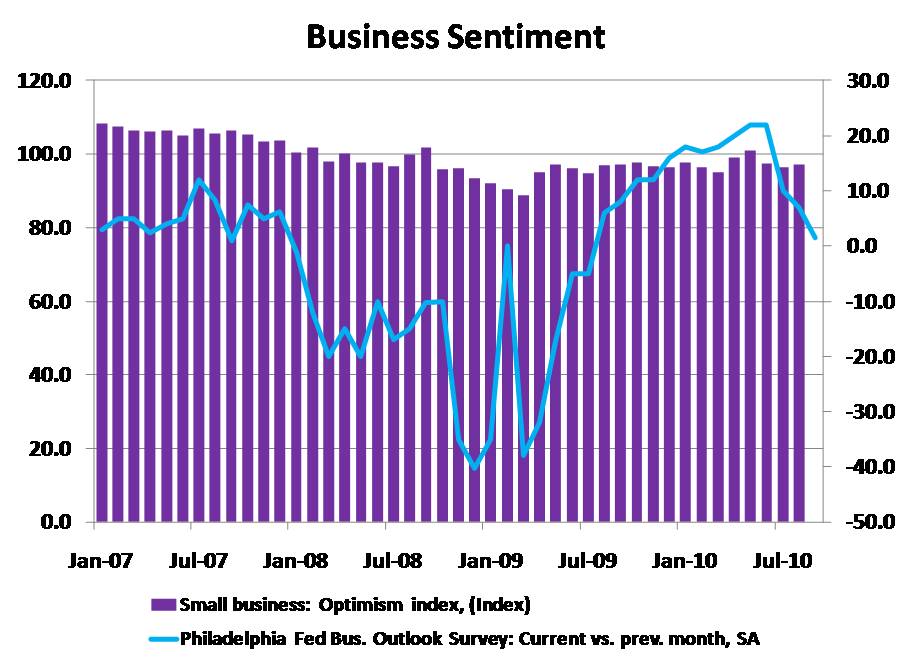

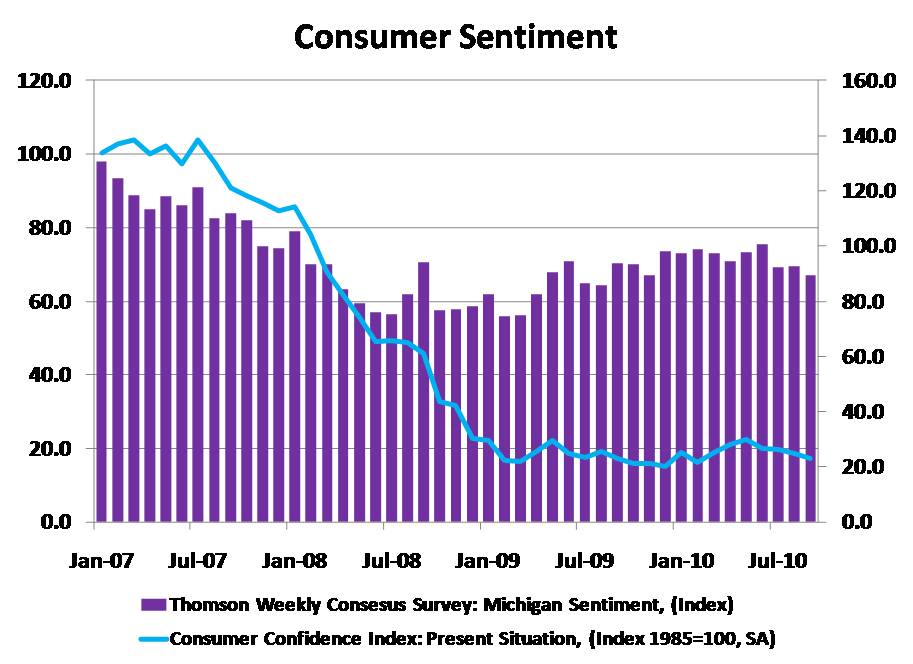

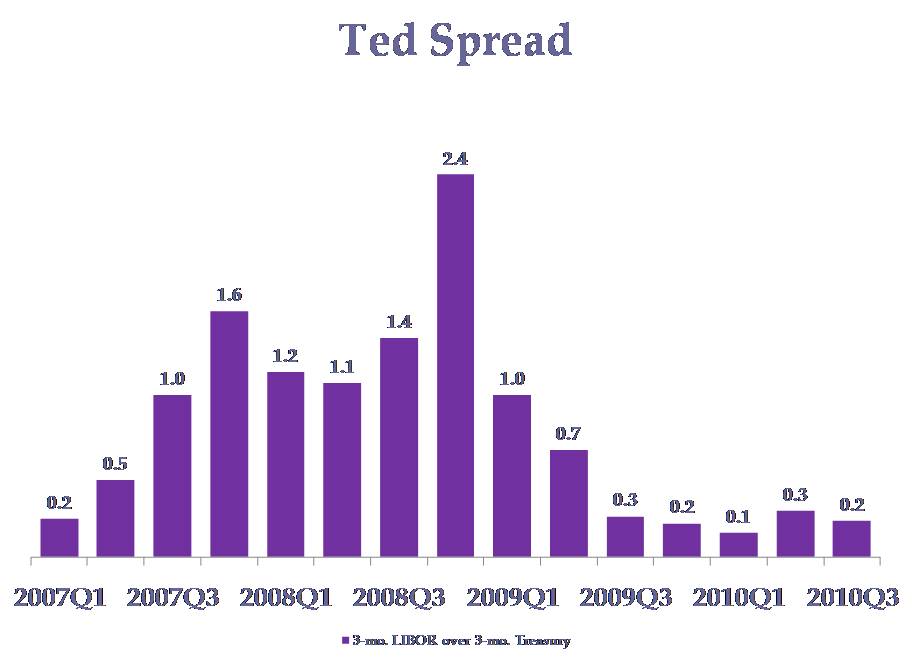

We present a graphical summary of factors that may indicate a shift in equilibrium below. The factors measure how households, firms, and investors view the current situation including: the consumer confidence index, the business sentiment index, the Ted spread and/or the normalized Ted spread, and interest spreads such as the Baa–Aaa or the Aaa–TB10Yr. (The TB10Yr is the ten-year Treasury rate, and the Ted spread is the 3-month LIBOR minus the 3-month Treasury, and the normalized measure divides the Ted by the 3-month Treasury).

So, what has changed? Since July, consumer sentiment, business sentiment, and the normalized spread of the Baa-Aaa have slightly declined. These indicators are not sounding off any alarms. The normalized spread of the Aaa-TB10Yr is the one indicator here that might be cause for concern. It has been rising sharply for five months now, due to the TB10Yr falling faster than the Aaa rate, which was also what happened in late 2008. This normalized spread is now at 70 percent of the ten-year treasury rate, compared with reaching just under 110 percent in late 2008. The Ted and Normalized Ted spreads have been consistently falling since they spiked in late 2008. They may not reach their historic averages in the near future, but we have seen noticeable improvements from tracking this variable over the past few quarters.

Although still not back down to average levels, overall these variables show a much more optimistic economic climate than compared with two years ago. Our analysis ultimately suggests that, at least for now, we have avoided shifting back to a bad equilibrium.

There has recently been talk of further quantitative easing. Quantitative easing that occurred in the past consisted of buying bonds (mostly long-term treasuries and mortgages). While it was an innovative and timely policy in 2008, we are not so sure that quantitative easing should be used again at this time. The Fed should understand that the necessary rebuilding of balance sheets will take more time, and slow growth during that time is what we should expect. We worry that further rounds of quantitative easing will unnecessarily shift risk from bondholders to taxpayers. From the charts shown here it is also the case that bond markets are functioning much more normally than they were in late 2008, reducing the benefit of quantitative easing.