CERF Blog

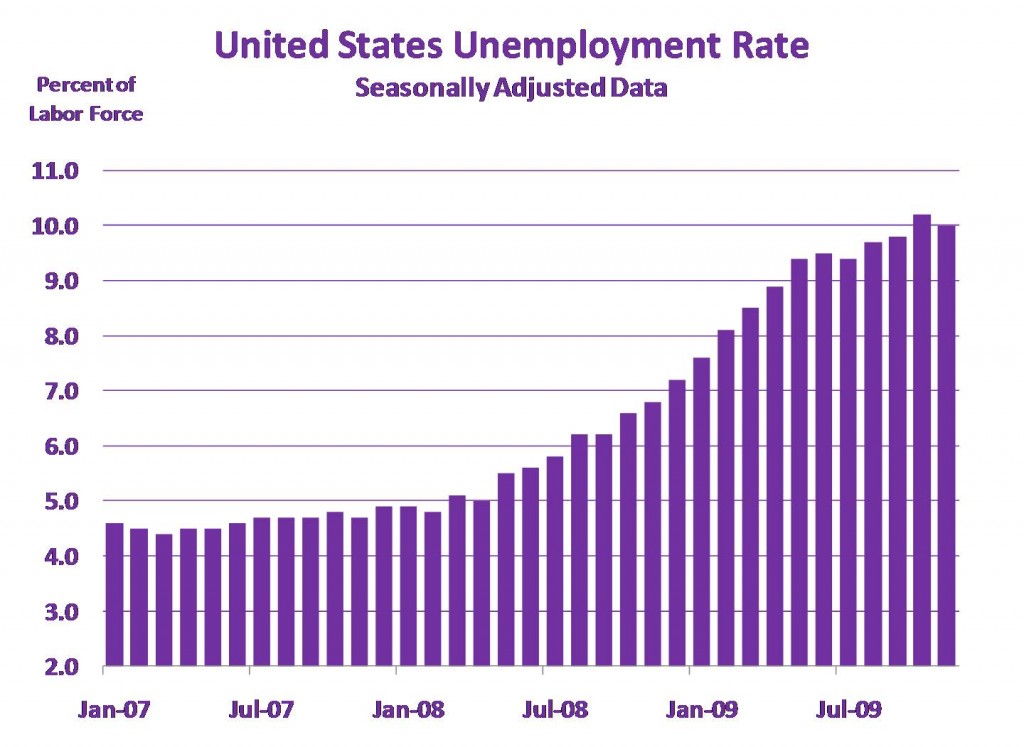

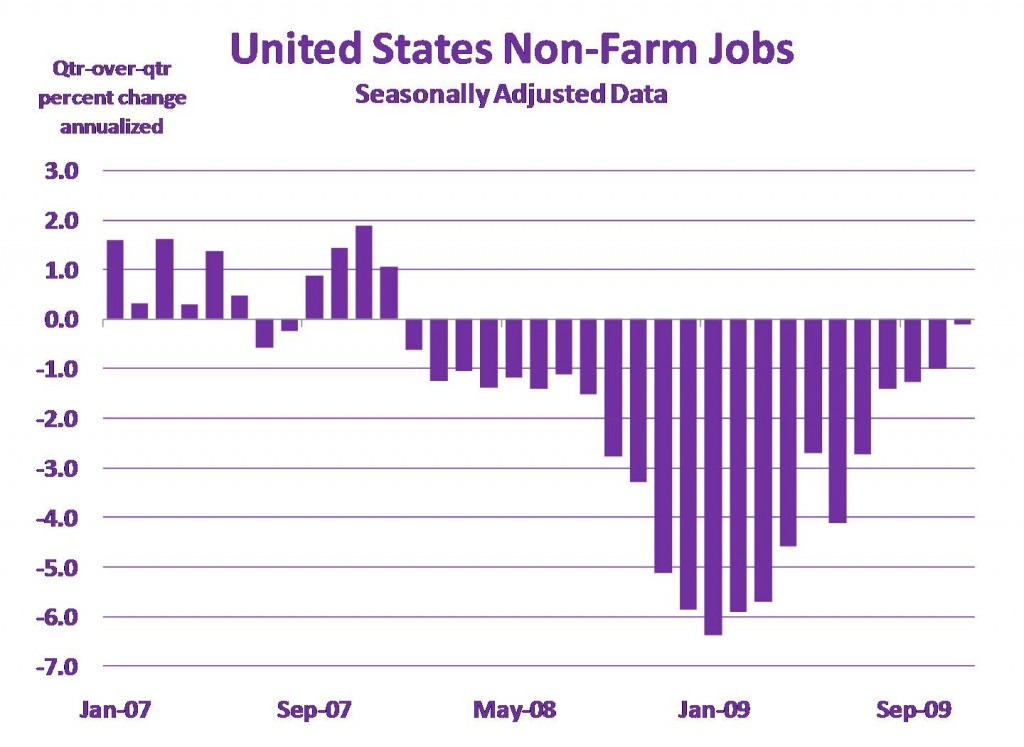

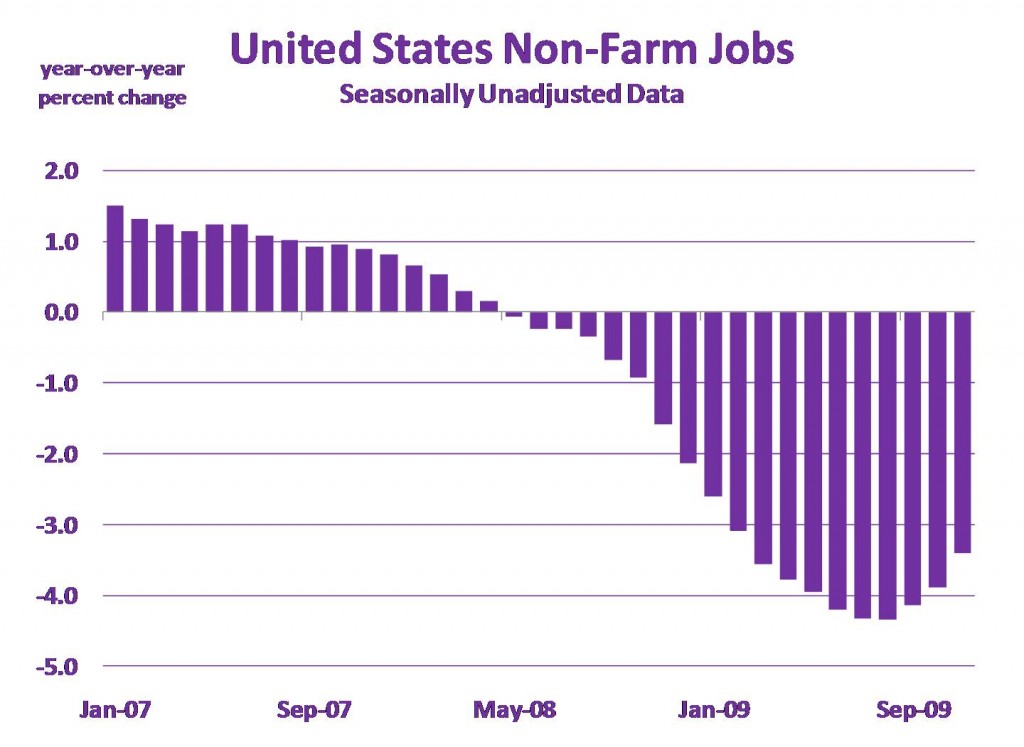

The United States employment situation improved substantially in November. The unemployment rate fell a bit and quarter-on-quarter job losses slowed dramatically, almost to zero. This welcome news has been greeted with rises in equities and a fall in Treasury bonds. I have attached four charts below.

Are we out of the woods? No. Is this an identifiable trend to recovery? Not yet.

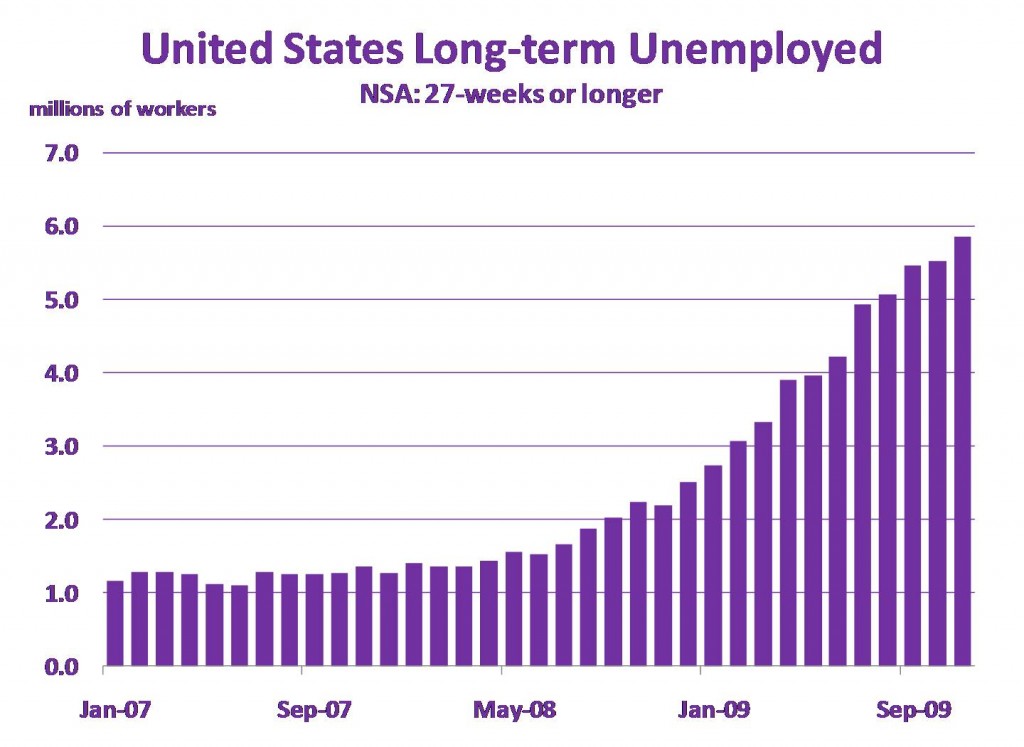

From the charts, you can see that job levels are still 3.4 percent lower than they were at this time last year. Also, the ranks of the long-term unemployed, those workers who have been unemployed for 27 weeks or longer, have grown to almost 6 million.

You can also see that the unemployment rate fell in July, before rising by more than 50 basis points during the next three months. Hopefully, this time, the unemployment rate will not rise in December, but continue falling.

A key dynamic that has been going on for about a year now appears like it will continue at least through the middle of 2010, and that is the negative feedback from jobs to residential real estate. This recession started in residential real estate with deflation of an over-leveraged housing bubble. It then spread to virtually every other sector in the economy, and once job losses started, the negative feedback loop started. Certain aspects of the housing correction were worsened by the job losses – especially foreclosures.

With high unemployment rates, lots of long-term unemployed persons, and job-levels still relatively low this feedback will continue. The most recent United States residential foreclosure rate data indicate that the foreclosure problem is worsening. The most recent data on commercial real estate loan delinquencies also indicate a steadily worsening problem.

What drove jobs down? One of the biggest factors was the tremendous fall in consumption during the second half of 2008. Our interpretation of that fall was the household sector moved to correct over-leveraged balance sheets. With ongoing real estate loan delinquency problems, we are not convinced the household sector will be motivated to increase their spending levels in the near term.