CERF Blog

It has been 57 years since Milton Friedman wrote his paper “The Case for Flexible Exchange Rates” where he argued that the benefits from a market economy and a free trade system would be enhanced by flexible exchange rates. This implied a freely floating dollar, whose value was to be determined by the buying and selling by participants responding to incentives and economic activity. At the time of his article, the dollar was pegged to Gold, in the Bretton Woods international monetary system. About twenty years after Professor Friedman’s article, the Bretton Woods international monetary system completely collapsed. Since then, the United States dollar has been a fiat currency, de-linked from a real asset like gold. While speculative activity can influence the value of the dollar, fundamental factors play a larger role in the long-run, including beliefs about the economic fundamentals of the country and perceptions of political stability.

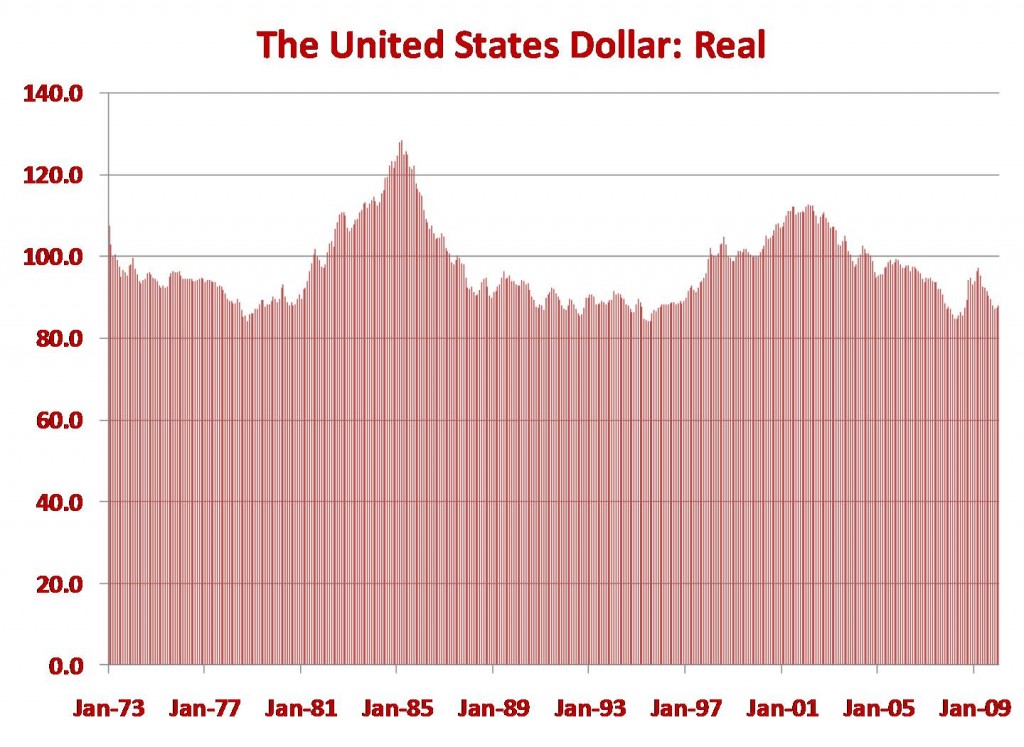

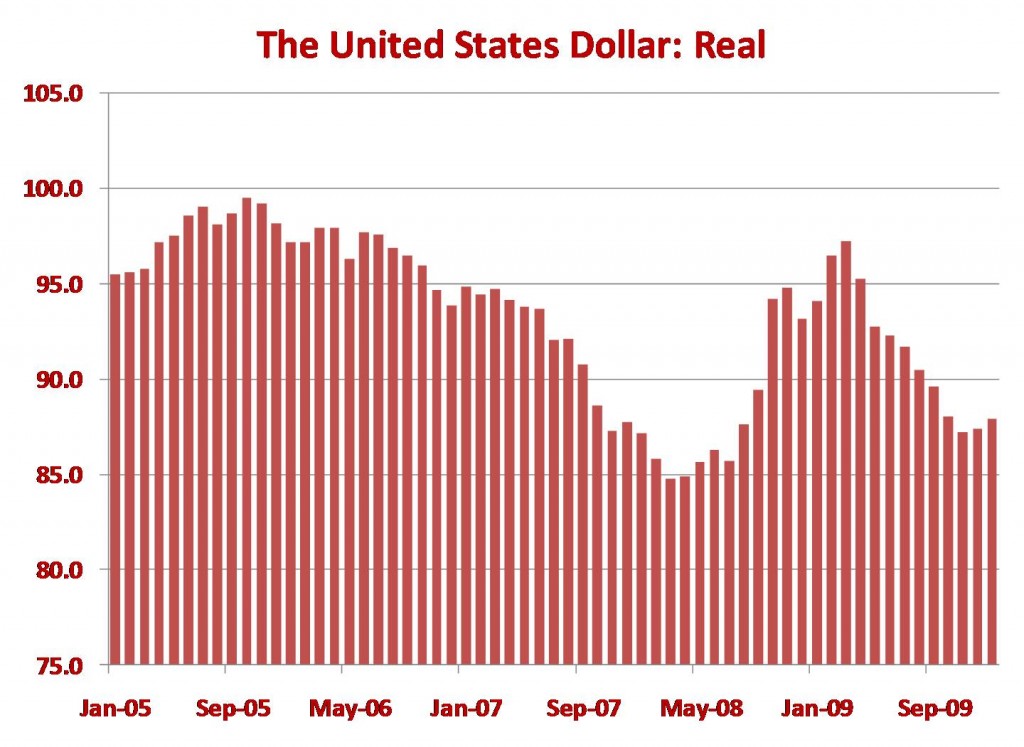

A chart of the dollar’s value, measured in real terms, show that it has been remarkably stable since 1973. The freely floating dollar has not caused a financial crisis since then. This includes, which is highly noteworthy, the major financial upheaval that the United States just went through in 2008. I provide a second chart that shows the same data from January 2005 until now, and we see that from a low in March 2008 the real dollar rose to a recent high in March 2009. This period included the financial crisis. In fact, not only was the dollar stable during the crisis, it rose. Given the experience of the last 37 years, Mr. Friedman’s theory is a good one. I see no reason for the United States to pursue a “strong dollar” policy. All that is needed are responsible short and long run economic policies.