CERF Blog

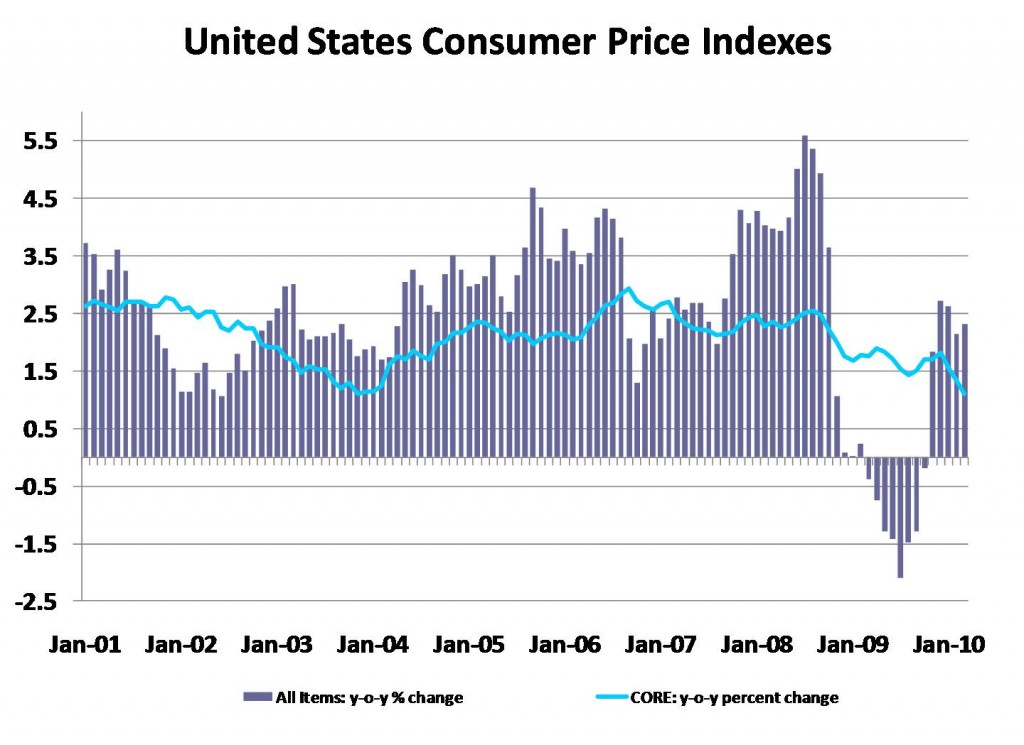

Recent data releases show that inflation remains well contained. In fact, by one key measure, inflation is at a historical low, causing increasing concern about deflation. From the March Consumer Price Index press release we see that first quarter overall price levels have grown about 2.3 percent from 2009 quarter 1. This measure includes energy and food components that are volatile. The Core CPI, which omits food and energy components, is much lower at 1.3 percent year-on-year. The Consumer Price Index measures prices in a way that presumes that households have no ability to switch out of certain goods/services/commodities if their price rises. It measures inflation for a fixed basket of items.

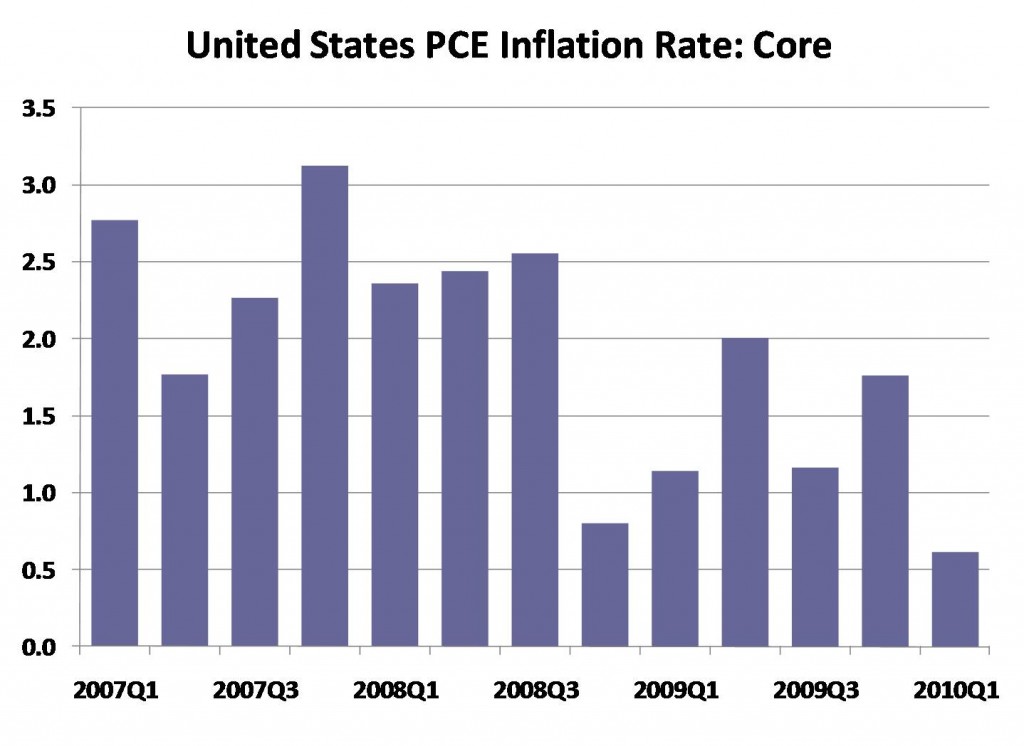

The national accounts Core PCE deflator, a measure of prices that does not fix the basket of items so rigidly, is the measure that the Fed watches most closely in setting monetary policy. From Friday’s first estimate of GDP we also have the first estimate of Core PCE inflation for 2010 quarter 1. It is now at its lowest quarter-on-quarter growth rate since 1959 at 0.6 percent. Charts of these data are included below.

It is interesting that with real consumption growth of 3.6 percent, inflation is this low. Apparently, it is the household who has the upper hand in the retail marketplace. This will likely continue for at least another quarter.

Low Core PCE inflation makes the FED’s job easier, as their expansionary monetary policy has not yet created any inflation. This is a good thing, since monetary policy challenges still remain. As the NBER admitted a couple of weeks ago, we are not necessarily out of the woods yet.