CERF Blog

It is time to write about inflation. From fall of 2008 until about a month ago I was more concerned about deflation than inflation. In my post last fall, I characterized the United States economy as being in a “Good-delation Equilibrium”, one that eased pressure on households and the Fed in a weak-demand economic environment. I believe that the environment is changing.

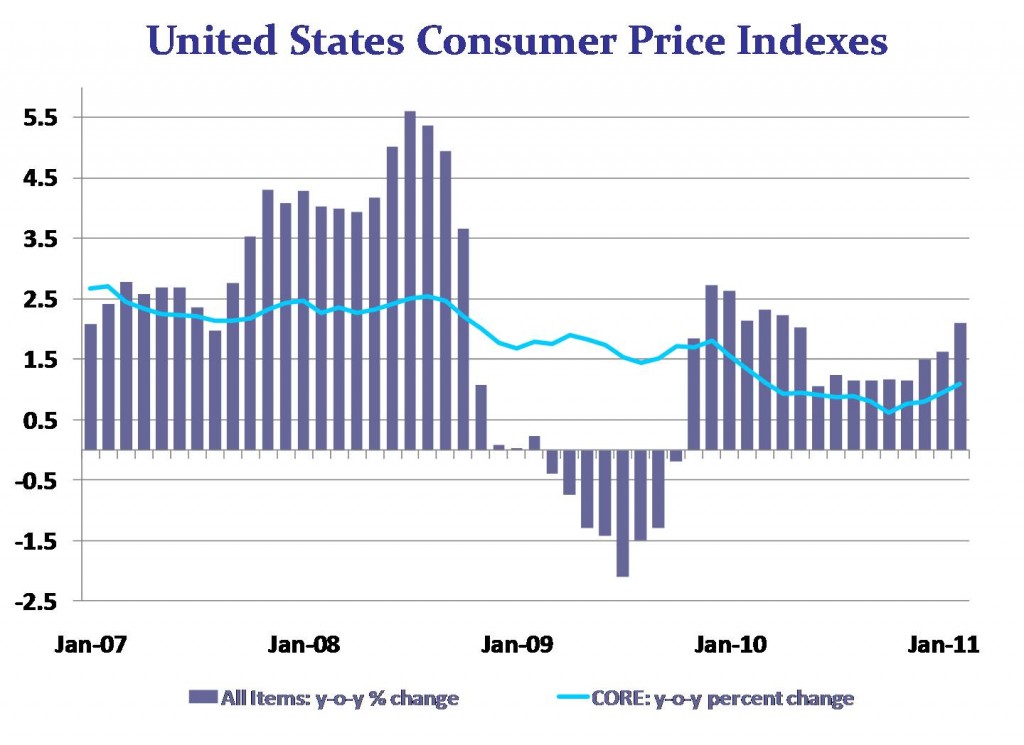

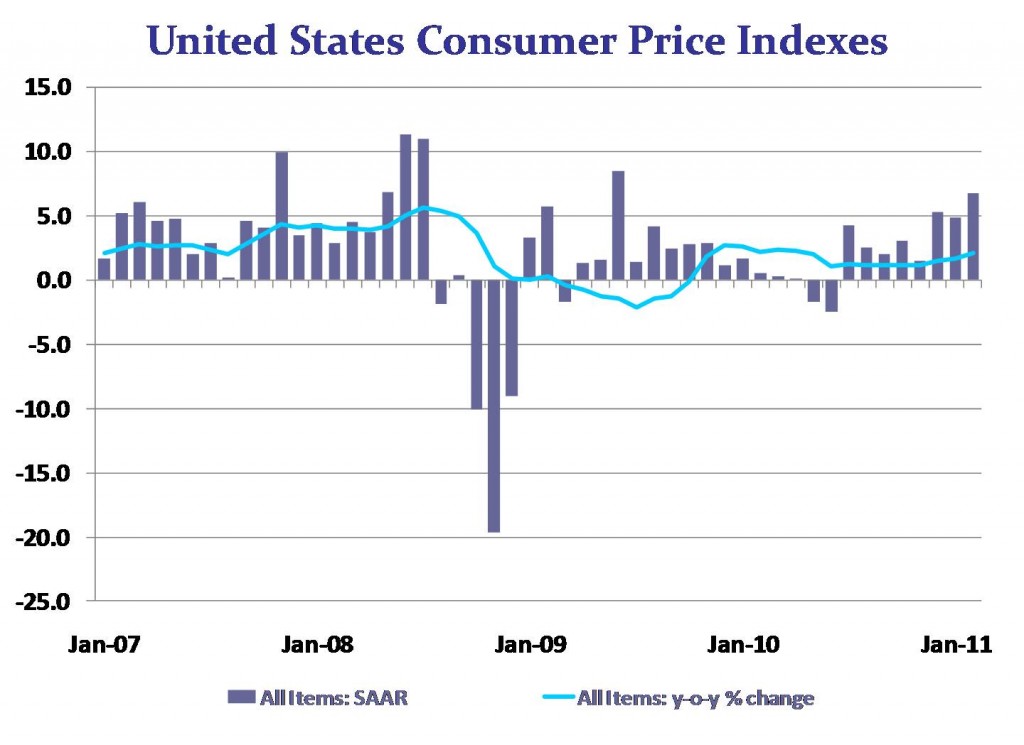

BLS data show that February year-on-year growth of the Core CPI has reached 1.1 percent, up from the recent low of 0.6 set October 2010. All items CPI growth has reached 2.1 percent. While energy was the largest driver, most of the other CPI categories also contributed to the rise.

What are the indicators for March? March import prices were up, oil prices were up, and the next employment cost index report, due out April 29, will likely show some gains. Any wage and salary gains will help this job-weak recovery, but will also contribute a bit to inflation.

What does this mean? Despite ongoing fundamental economic weakness, we have likely moved past an episode where Deflation was a valid concern.

As an aside, it also has an implication for our real interest rate forecast. Many nominal interest rates, especially longer Treasuries, are rising. Thus far, we have about a 100 basis point rise in the (nominal) ten-year Treasury in the last six months. We had a similar rise in the All items inflation rate in that same time whereas the Core inflation rate increase was about half that. In the case of the All items deflator of the Treasury yield, the implied real rate has not changed, but with the Core deflator, the implied real rate rose by about 50 basis points. Either way, we have yet another fundmantal indicator, real interest rates, that is not improving.

While I no longer characterize the situation as a “Good-deflation Equilibrium” we have not moved very far from that equilibrium at this point. However, we may be in the process of moving to an equilibrium with higher inflation than the February level. There are reasons to believe that the current course of debt-financed expansionary fiscal policy will lead to higher future inflation. This course of fiscal policy will likely be maintained through 2012. It is likely we will get to a point in 2011 or 2012 where the Fed will consider raising the Federal Funds Target rate.