CERF Blog

Written October 16, 2023

A Review of 2023 Thus Far

Earlier this year we said these things regarding the U.S. economic outlook:

The U.S. economy will not experience a recession in 2023.

The economy will experience Stagflation: slow-growth and persistent inflation that is well above the Fed’s inflation target of two percent.

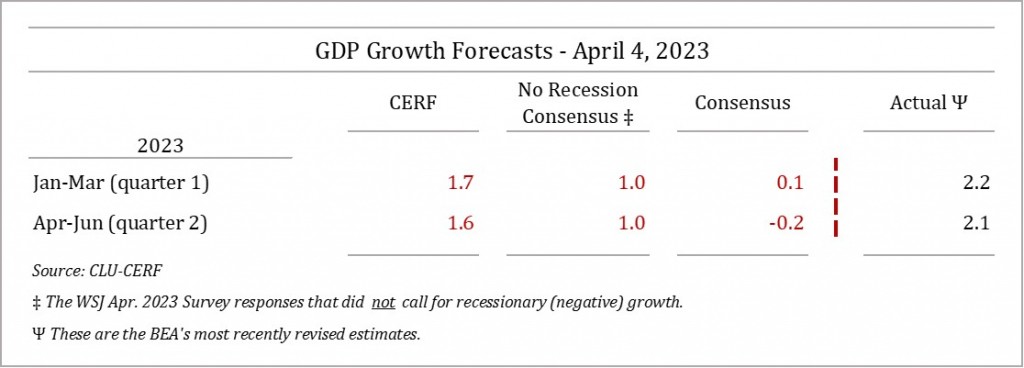

On April 4, 2023 CERF published the forecasts for the U.S. economy shown in Table 1.

Table 1: CERF’s Economic Forecast: Comparison against Actual

We had forecasted growth that was lower than the National economy’s potential, but growth that was clearly not recessionary. Forecasted values were 1.7 percent for quarter 1 and 1.6 percent for quarter 2. The Wall Street Journal “No Recession” consensus forecast called for growth of 1 percent for each of quarters 1 and 2. Enough time has now passed that the official measures are available, and the actual growth figures are 2.2 and 2.1 percent for quarters 1 and 2, respectively (as shown in the column labeled “Actual”). CERF’s forecast was substantially closer to the actual growth figures than the no recession consensus.

As a side note, the “No Recession” consensus figures shown in Table 1 are the average of just those forecasts that were not predicting recession at the time. This represents a more apples-to-apples comparison to CERF, since we were also not forecasting a recession. The average of all consensus forecasts is lower (0.1 percent for quarter 1 and -0.2 percent for quarter 2) since the overall average includes a number of forecasters who were predicting recession at the time.

These figures are in Table 1 as “Consensus”, and they show CERF as being yet closer to the actuals compared to the consensus.

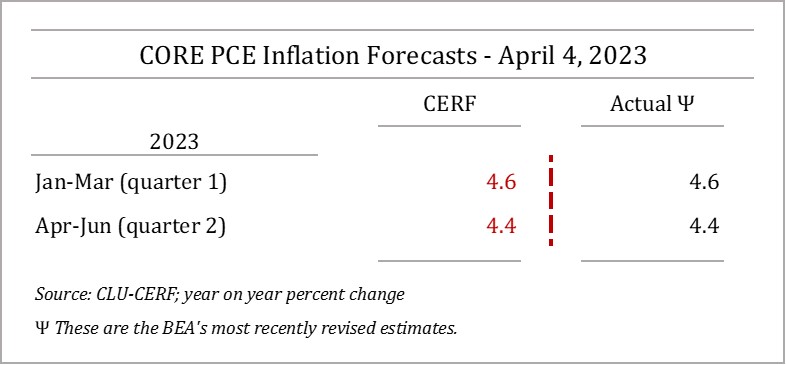

Table 2: CERF’s Inflation Forecast: Comparison against Actual

CERF’s April 4, 2023 U.S. inflation forecast is provided above in Table 2. CERF had forecasted 4.6 percent inflation for quarter 1, and 4.4 percent for quarter 2. The current official measures shown in the “Actual” column are equal to the CERF forecasts. Or, another way of saying, we nailed it.

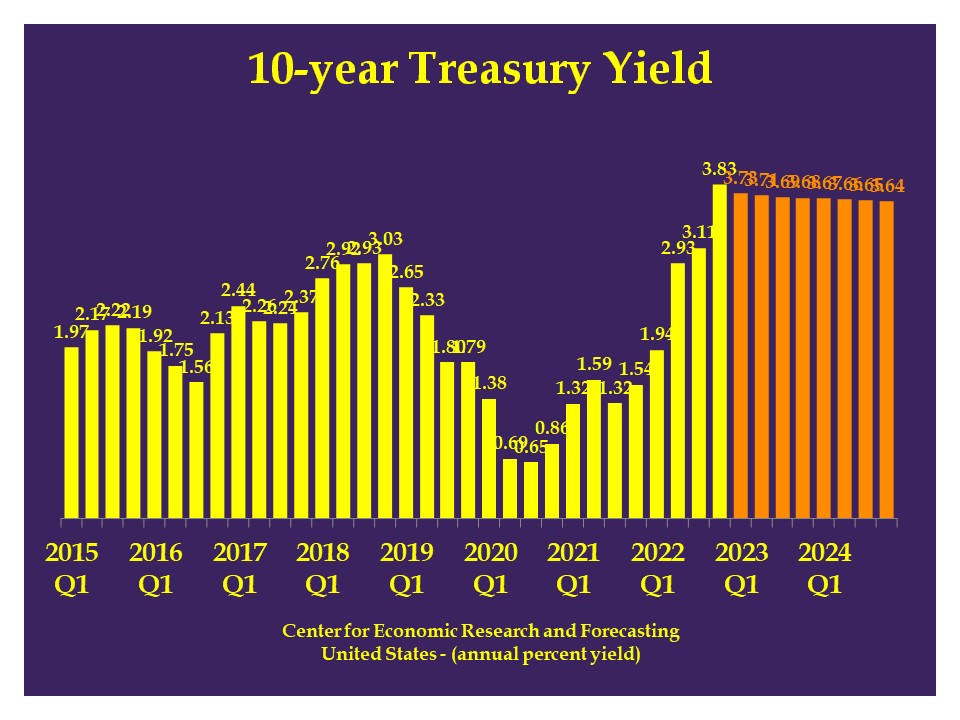

CERF’s April forecast of the ten-year Treasury was fairly flat with only a slight decline in rates, as shown in Figure 1. We advised our clients that with the unconventional monetary policy the Fed had been pursuing since 2008, normal price discovery in financial markets was not occurring. Thus, the price for the ten-year Treasury was not driven by fundamentals.

Figure 1: CERF’s April 2023 Treasury Yield Forecast

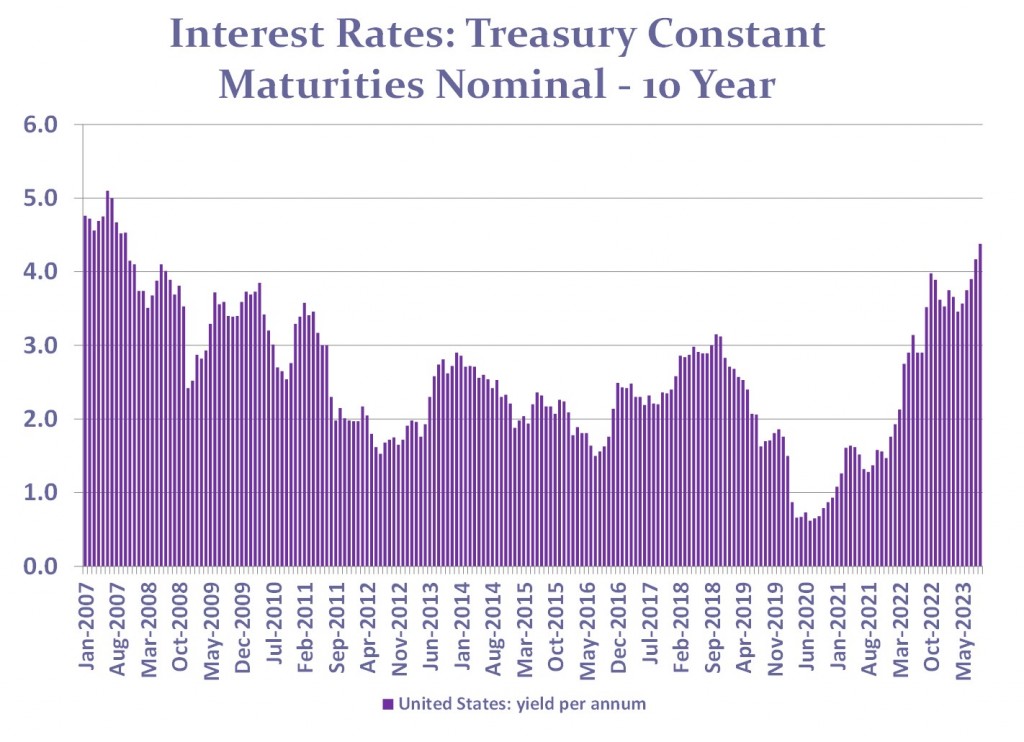

While CERF’s quarter 2 forecast was close (we forecasted 3.7 and actual was 3.6), our quarter 3 forecast was off somewhat (we forecasted 3.6 whereas the actual was 4.2). In the case of quarter 3, the direction was incorrect. Rates are rising (see Figure 2), not falling. Some financial market commentators have proposed that the market is now repricing the ten-year Treasury. While this appears to be the case, we advise our clients that markets are still massively distorted, therefore the price mechanism is still broken. The causes of this distortion are near-zero real rates, the Fed’s policy of paying interest on reserves, and the Fed’s $8 trillion balance sheet. Until Fed’s extraordinary monetary policies have been normalized and price discovery has been restored, we expect volatility in fixed income and in equities as well.

Figure 2: Recent Treasury Yields

CERF’s October Outlook for the U.S. Economy

With the accuracy of our April inflation and GDP growth forecasts, CERF feels that the assumptions and structures underlying that forecast remain a valid foundation for our current two-year outlook. We calculated our current forecast based on the assumption that the Fed will hike 25 basis points on November 1st. The main risk to this assumption is the recent rise in yields. It appears that the Fed sees this as justifying a pause. A Fed pause would continue a pattern of Fed capitulation to markets. This is a hallmark of the Powell Fed. If they pause, we believe the probability the Fed is done hiking is high.

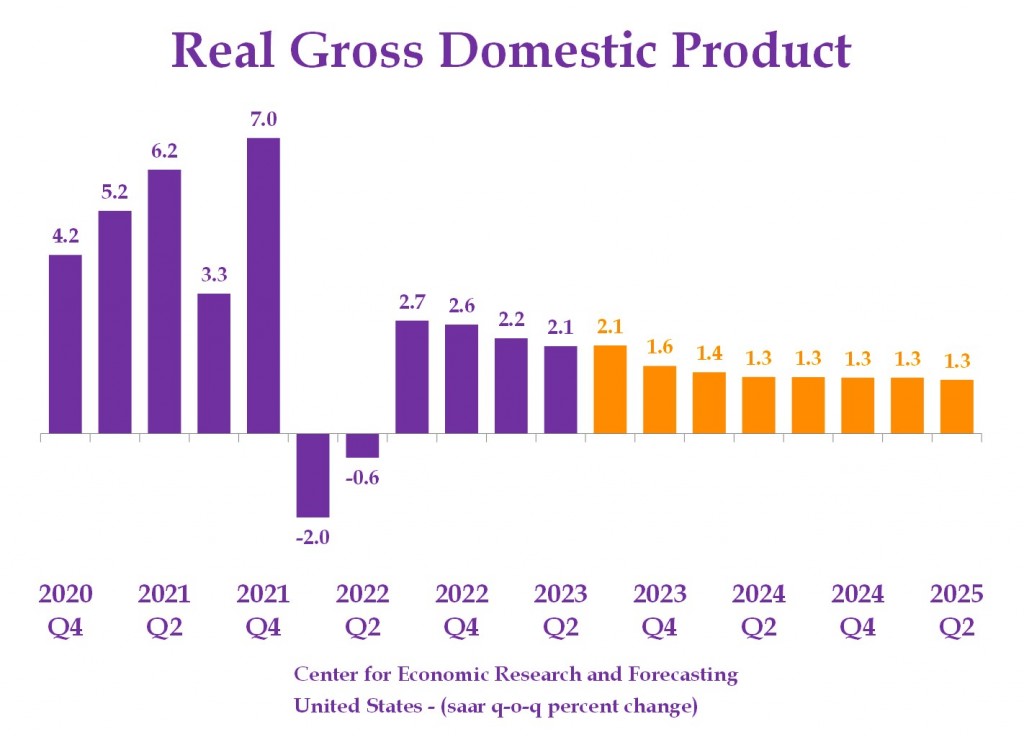

We continue to forecast Stagflation, that is, very slow growth and inflation well above target. Near-term GDP growth might exceed two percent in quarter 3, but thereafter we predict that growth will slow. The two most important factors for 2024 and 2025 growth are the restrictions on economic activity that monetary policy and fiscal policy are causing.

Figure 3: CERF October 2023 GDP Forecast

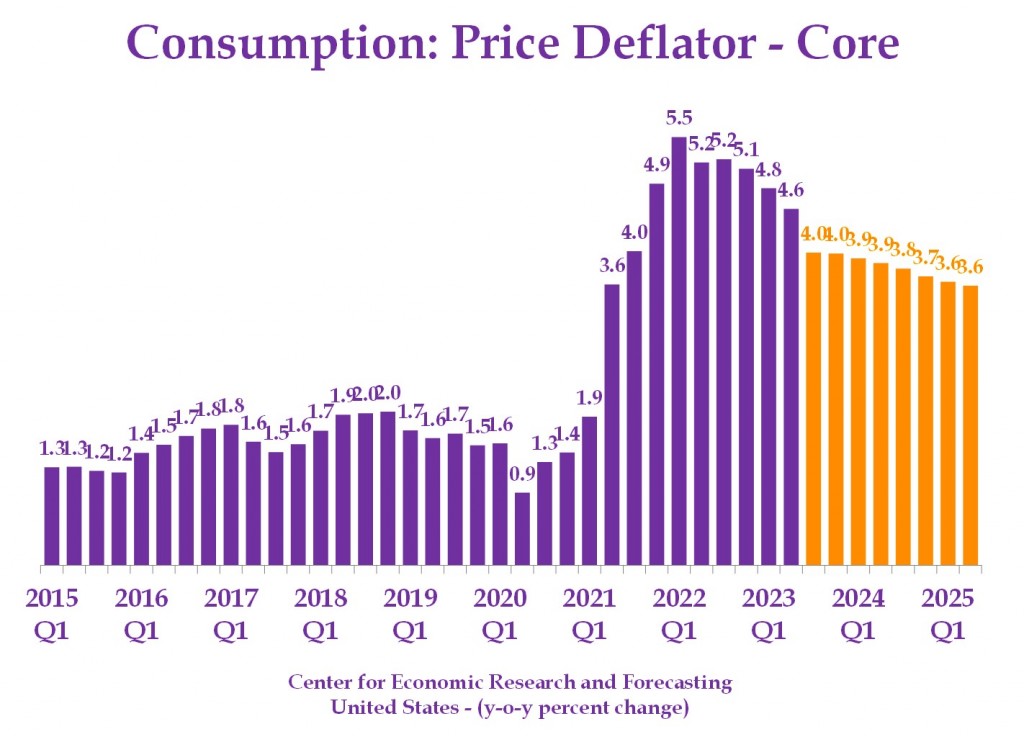

Figure 4: CERF October 2023 Inflation Forecast

We continue to forecast persistently high inflation, well above the Fed’s target of two percent. If inflation does continue to be significantly higher than the Fed’s target, there is a possibility that the Fed’s resolve to fight inflation will cave and they will raise their target. We also mentioned this possibility in April, however, the probability of a high Fed inflation target is greater now.

Washington DC’s policies, both monetary and fiscal, imply that the financial system and the broader economy are fragile. It would not take much of an unforecastable shock to send the economy into recession. In such an event, the recession would very likely be preceded by a financial crisis.

The BEA’s Data Update

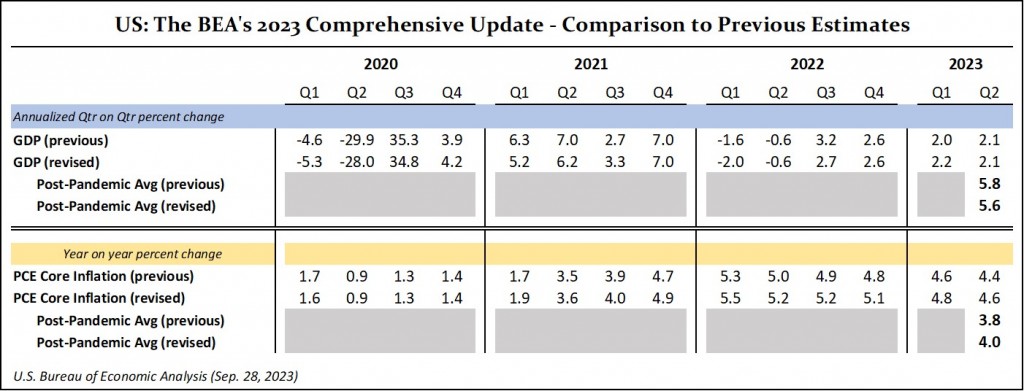

On September 28, 2023 the U.S. Bureau of Economic Analysis released their Comprehensive Update on the U.S. economy. The economic growth and inflation revisions are provided below in Table 3.

Table 3: Updated Measures of U.S. Economic Performance

The revisions reveal an updated understanding of the U.S.’s post-Pandemic economy, which is that average growth since 2020 Q3 was slower, 5.6 percent, compared to the previously estimated average of 5.8 percent. Average inflation was 4.0 percent rather than the 3.8 percent value that was our previous understanding.

Narrowing our focus to last year and a half, the updated estimate of average economic growth is now measured at 1.2 percent, compared to the previous value of 1.3 percent. Average inflation is now measured at 5.1 percent, compared to the previous value of 4.8 percent.

These revisions support CERF’s previous forecasts and current outlook. Slow economic (and income) growth and the high inflation are not good for lower income households and this is not healthy for the overall economy.