CERF Blog

February 20, 2025 (original version)

March 11, 2025 (updated)

The Socio-Economic Importance of Housing

A year ago, I outlined a variety of social and economic impacts from housing in the essay “Housing and Growth”. A link to the full essay is here. To review, I provide a list of the socioeconomic impacts here:

- Housing is a necessity for family formation, work, and life

- Home ownership is a key rung on the ladder of upward socio-economic mobility

- Housing has a large economic multiplier, that is, a new house generates additional economic activity, jobs and income, with a larger economically stimulating effect than most industries

- A lack of housing contributes to poverty

- A lack of housing contributes to income inequality

This year’s Ventura County Economic Outlook and Forecast essay documents a jobs-housing mismatch, where the majority of sectors contributing to jobs growth are in relatively lower-salary industries, preventing home ownership. This closed door to home ownership creates a barrier to socioeconomic mobility. Home ownership is all-important in providing a financial base with which households can seek further economic improvement; we might think of Ventura County’s severe lack of housing affordability (described in detail below) as actually removing two rungs from the socioeconomic ladder, not just one. This limits human flourishing, especially among the disadvantaged, and is an unyielding roadblock to an egalitarian set of opportunities in our County.

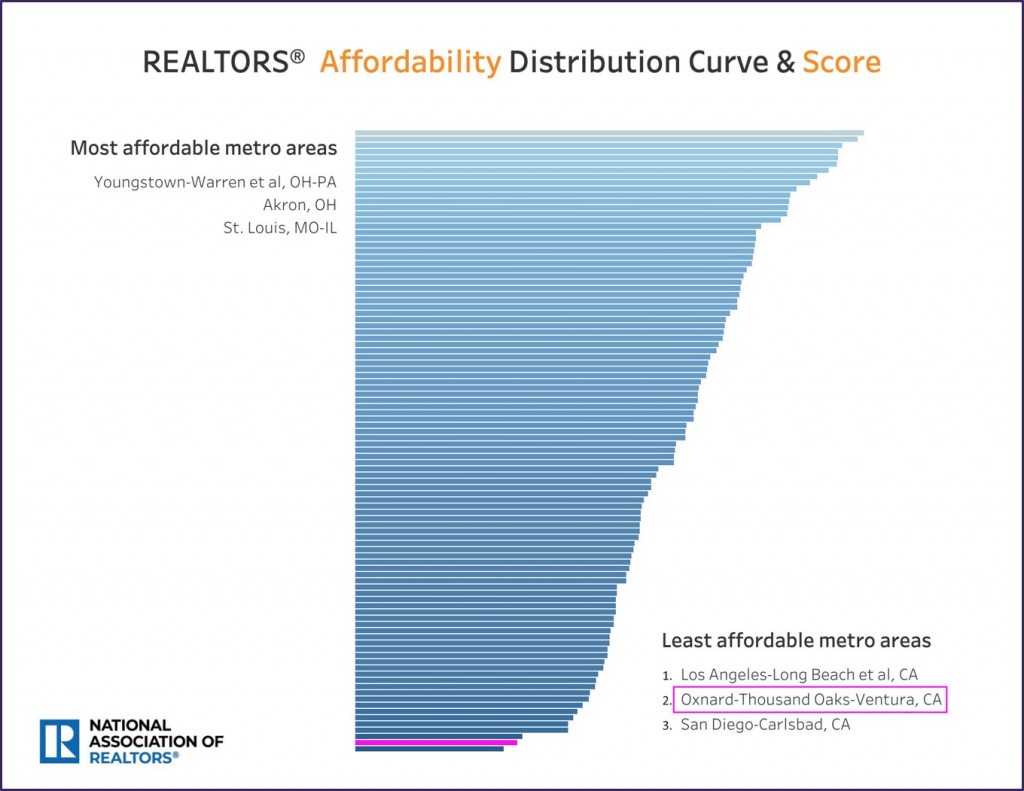

Figure 1: National Association of Realtors Affordability

Figure 1 (above) shows that among the major U.S. metropolitan areas, Ventura County is the next to worst metro in the United States with respect to housing affordability. This might be a bit surprising, as there are other localities that have higher prices than Ventura County. I explain and document the relation between housing costs and income levels in detail below.

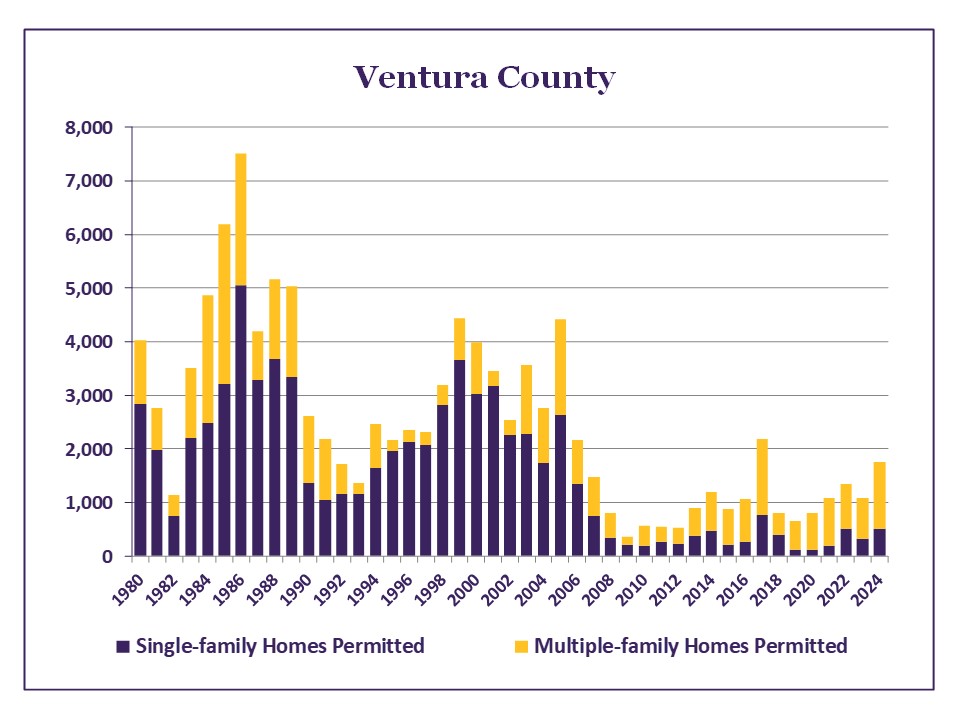

Housing Production

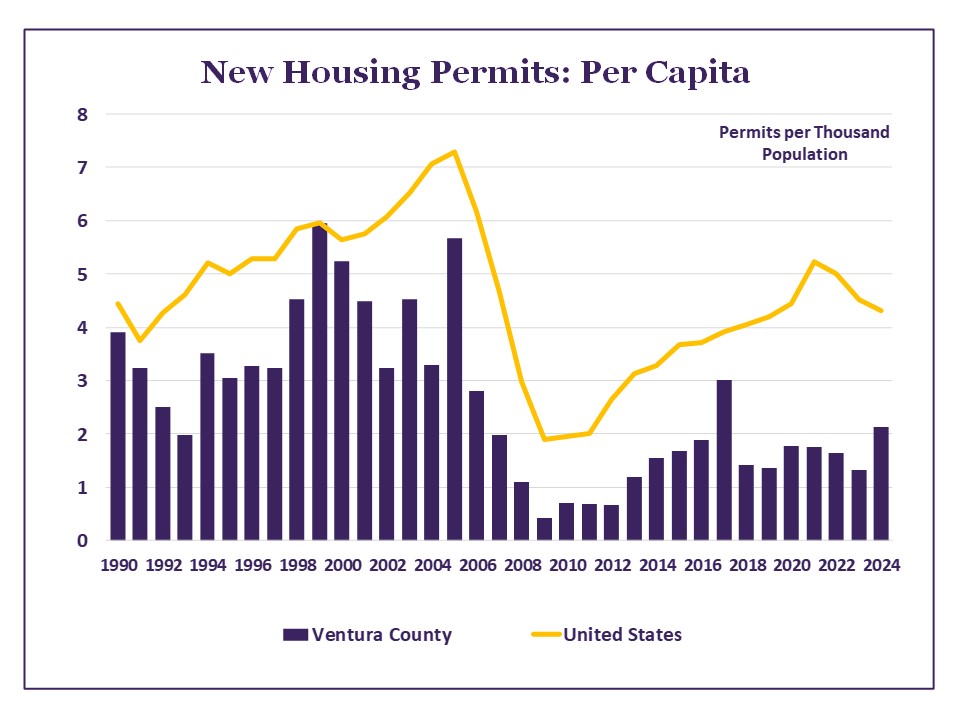

As CERF has previously documented, the U.S. home production rate is historically low, as economic expansions go. Over the past 60 years, U.S. new housing production steadily fell lower and lower in each business cycle of expansion and recession (see Fig.1 in last year’s essay – Link). However, even against that national backdrop, the Ventura County new home production rate is substantially lower.

Figure 2: Ventura County and U.S. Home Production

To remove the volatility of the data in Figure 2, I calculate decade by decade averages of U.S. and Ventura County new housing production rates and provide them in Table 1.

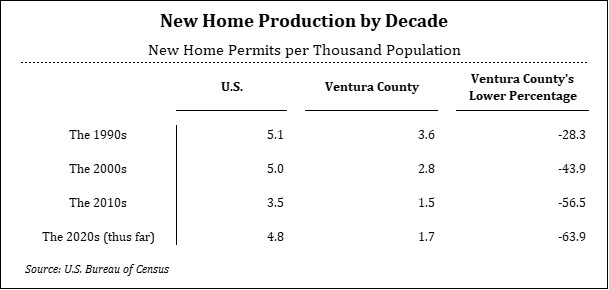

Table 1: Per-Capita Home Production by Decade

From Table 1 (above) Ventura County’s 1990s new home production rate was 3.6 new homes per thousand population, a rate that was 28 percent lower than the U.S. rate. Ventura County’s rate relative to the U.S. has been in freefall for some decades now. It fell to a 44 percent rate lower than the U.S. during the 2000s, it fell further to a 56.5 percent rate lower than the U.S. during the 2010s and thus far during the 2020s it has averaged a 64 percent lower rate than the U.S. And this is relative to a U.S. benchmark that itself has declined precipitously during these decades. Ventura County’s extremely low new home production rate has created a severe housing supply constraint. And with each passing decade, Ventura County’s home production falls farther and farther behind.

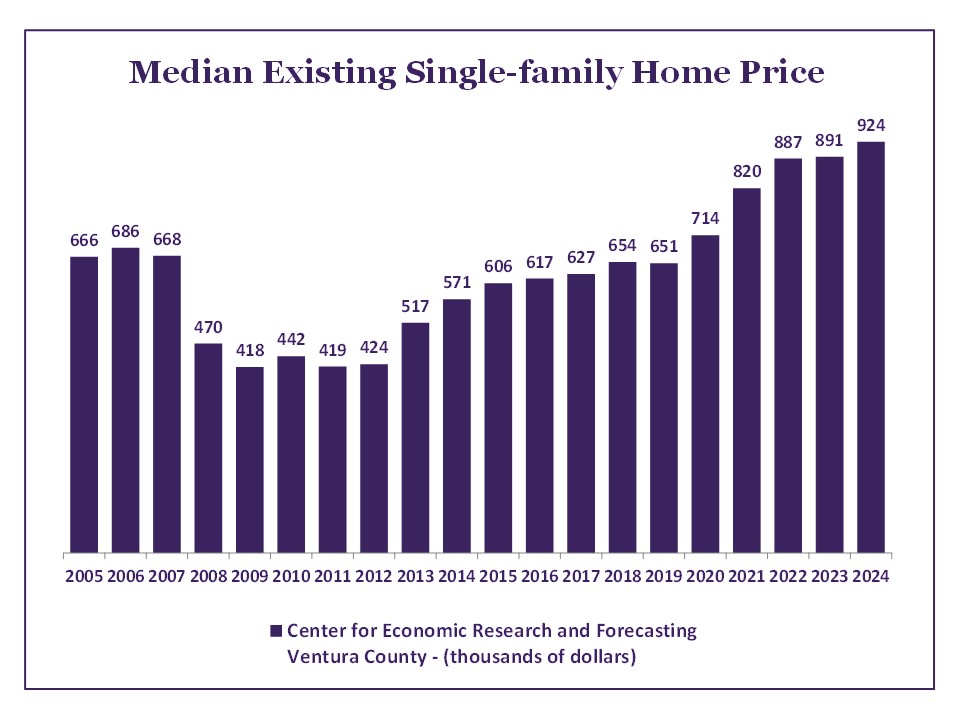

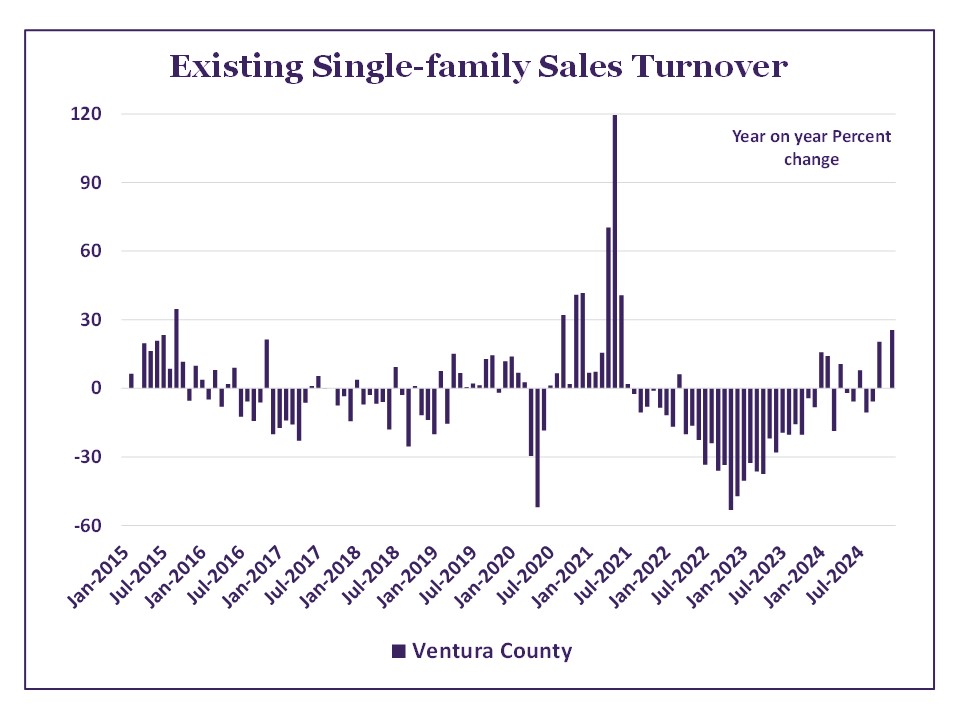

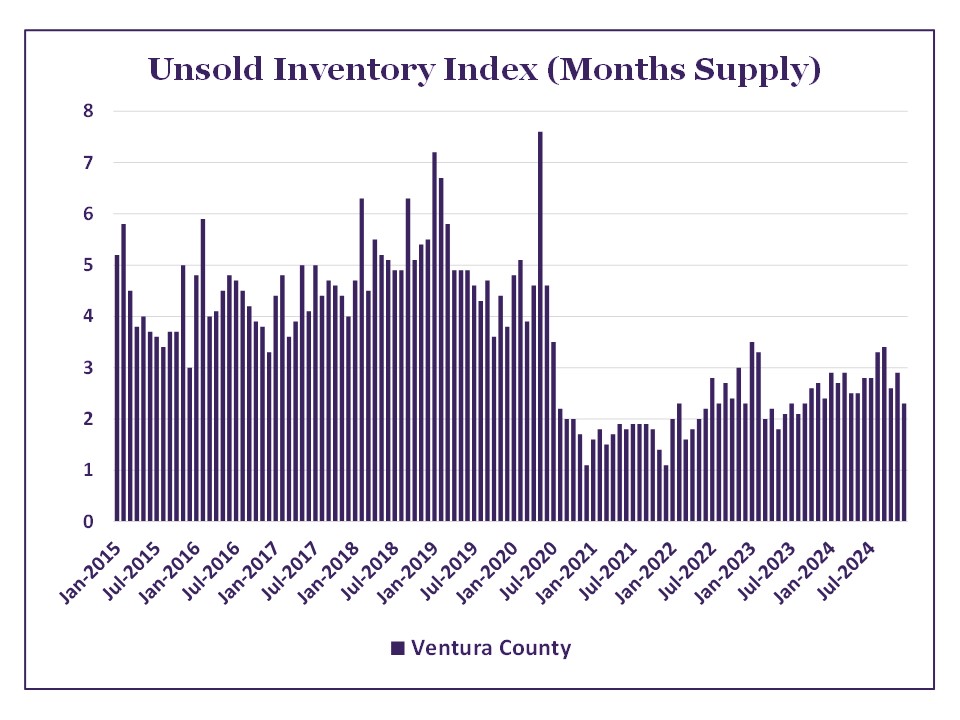

From monthly realtor data, we see that the median home price hit a high of $972,000 in July of 2024. This results in an annual average of $924,300. I expect that within two years, there will be monthly median home prices that exceed $1 million dollars. Importantly, these prices are for the median home, not a particularly nice, large, or recently built home.

The Dichotomy of Housing Costs and Incomes

Apartment Market Costs and Income

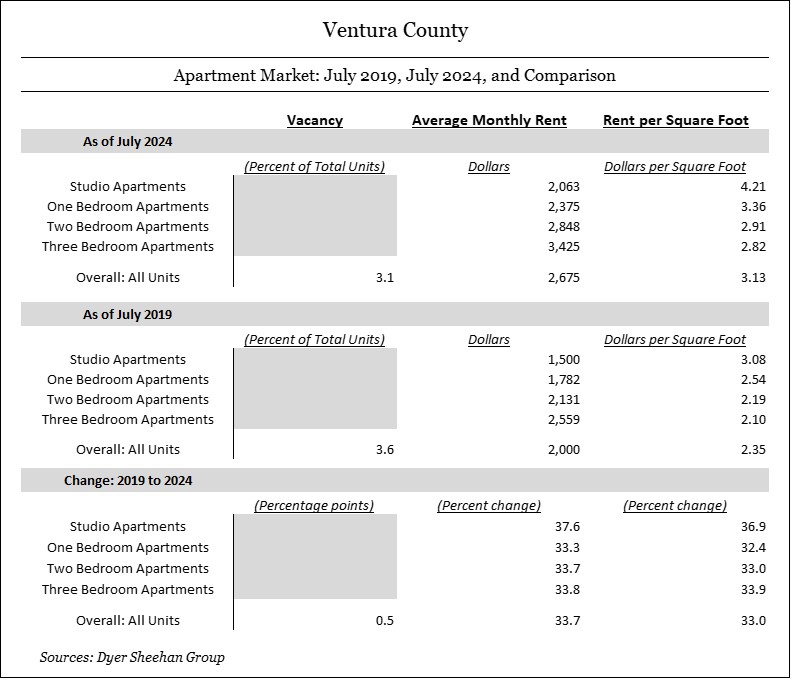

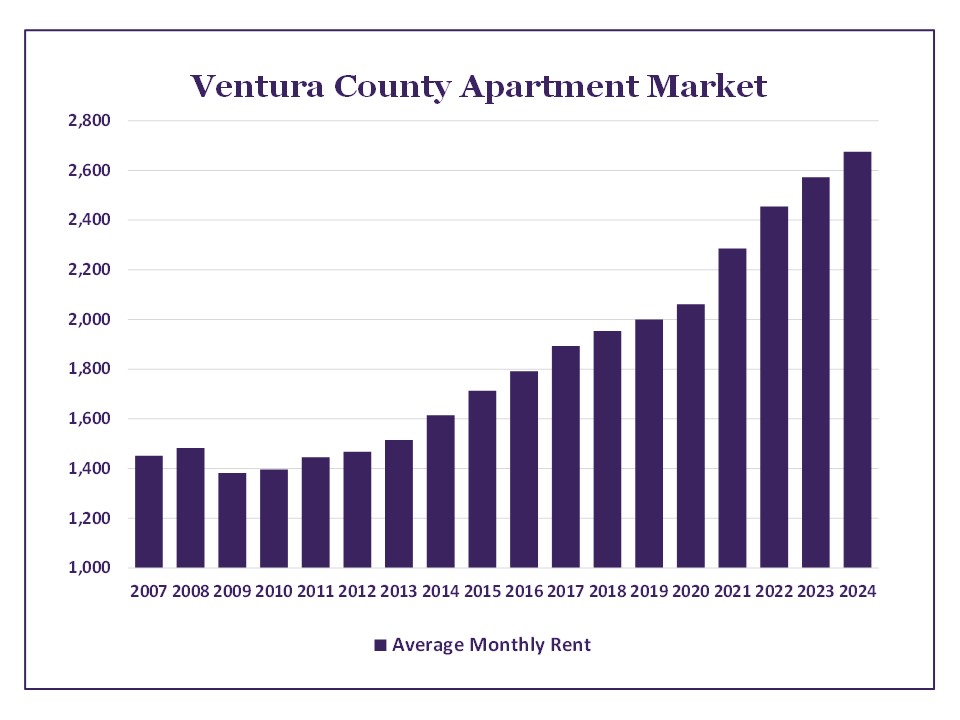

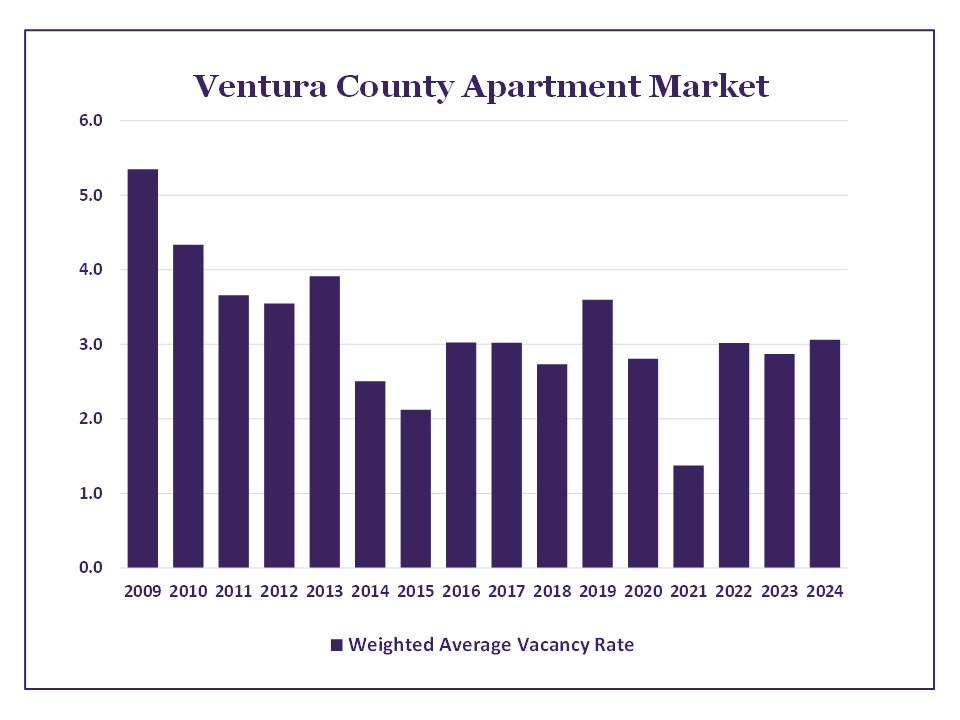

Using the Ventura County Apartment Market survey database from the Dyer-Sheehan Group, the overall July 2024 average monthly rent was $2,675, a rate that is a weighted average across all apartment types, including studios, one-bedroom, two-bedroom, and three-bedroom apartments. The two-bedroom apartment rate was $2,848, which is up 4 percent from last year, as is the overall average. The overall vacancy rate improved slightly from 2.9 percent to 3.1 percent, which is welcome, but this is still a remarkably tight market. For more detailed apartment market data, see Table 3, a bit farther below.

Figure 3: Economic Conditions for Ventura County Renters

To assess the conditions for renters, Figure 3 (above) shows the rent trend as well as the salary-to-rent ratio since 2007. Rents, the gold line and left scale, rose sharply from 2012 to 2020, but then, remarkably, rose at an even faster rate from 2020 to now. The salary-to-rent ratio, purple bar and right scale, was 33 percent in 2007 but by 2023 had fallen to only 26.3 percent. This is a devastating decrease of affordability for Ventura County renters. For much of the past 16 years, Ventura County’s apartment costs, and the salaries needed to support those costs, have been diverging, and since 2020 they are diverging at such a rapid rate that there are socioeconomic impacts.

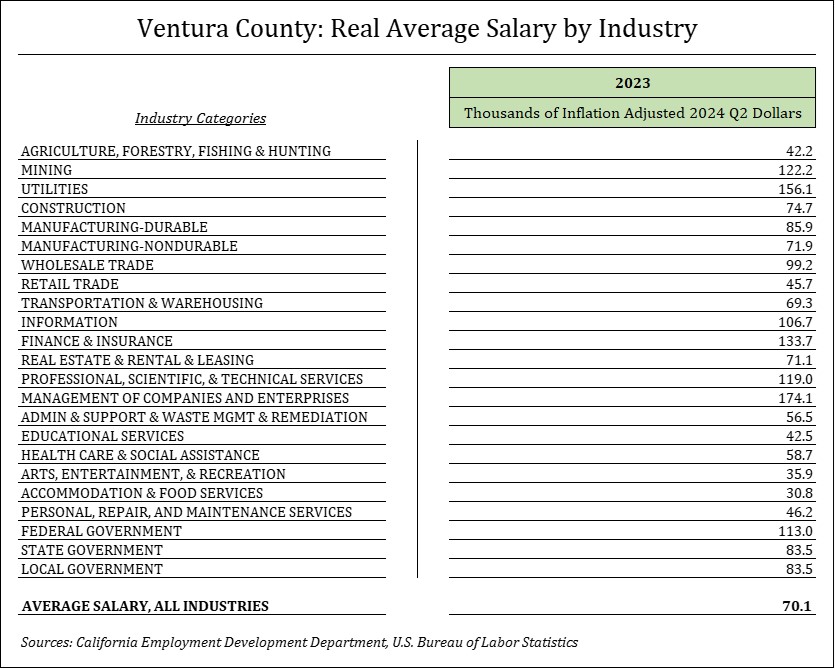

Based on the standard recommendation that no more than thirty percent of a person’s gross wages or salary should be spent on housing and using the smartasset.com take-home pay calculator, a renter would need an annual salary of $172,000 to afford the average two-bedroom apartment rent in Ventura County. The county’s 2023 average annualized salary (stated in 2024 Q2 dollars) was $70,100, which is less than half of the renter’s desired pay level. Only jobs in the Management of Companies sector, just one sector out of Ventura County’s 23 sectors, has salaries higher than $172,000. It does not seem possible that the economic mismatch between the job market and the housing market could be any greater.

Home Ownership Market Costs and Income

The California Association of Realtors median home price of $924,300 for Ventura County for the 2024 year implies a monthly mortgage payment of $4,781. Adding property tax, insurance, and income taxes, and following the 30 percent rule, a household would need to earn an annual income of $360,000 in order to afford the median home. This astonishing figure is almost 260 percent higher than the $140,000 annual income required to purchase the median home across the U.S. It is about 210 percent higher than the income required for a two-bedroom apartment as described in the previous section above. By any comparison, this estimate provides a dramatic indication of a truly severe housing crisis in Ventura County. This figure also helps us understand the departure of firms, households, workers, and our children from Ventura County to other locations in the U.S.

Table 2 provides the most recent Ventura County annual average salary data, stated in 2024 Q2 dollars, in considerable detail. Average annual salaries range from a low of $30,800 for Hotel Accommodation & Food Services to a high of $174,100 for Company & Enterprise Management. The average annual salary across all industries was $70,100. As impressive as the Company & Enterprise Management sector’s salary is, it is not nearly enough to afford the median priced home in Ventura County based on traditional guidelines (see previous paragraph). However, if there was a household that had two workers who both worked in Company & Enterprise Management, they would be very close to having the income needed to purchase a median priced home.

As mentioned above, this causes a severe limitation on human flourishing. All households should have access to the home ownership market, and through that, a chance to improve their standing socioeconomically.

Table 2: Ventura County Average Salary by Industry

Changing Policy

CERF recognizes that cities are working to bring new housing to market. However, they are forced to operate their planning and building/safety processes within the broader framework of land-use policy which has existed for decades. Ventura County’s land-use policy is the most restrictive in the United States. By changing this broad countywide framework to one where urban areas could be expanded in a thoughtful and strategic way, cities would have a more flexible and rational framework in which to operate. A rational expansion policy would breathe life to planning efforts and it would breathe life into the Ventura County economy. A change to the policy environment such as this would be a large step toward reconciling the severe mismatches, described in this essay, of Ventura County’s housing situation.

During the Pandemic Ventura County’s leaders had vision, bravery, and fortitude. They engaged in truly courageous policy-making which balanced lives and livelihoods during the extraordinary challenges of COVID-19. Let’s harness that courage and excellence and focus it on setting Ventura County in a new policy direction. Other communities who have their own jobs-housing mismatch would see Ventura County as a leader and innovator. But we would not be doing it for regional policy accolades, rather, we would be doing it because of our fundamental commitment to our workers and to our children.

Additional Charts and Tables

Table 3: The Dyer-Sheehan Group Ventura County Apartment Market Survey

Additional Charts