CERF Blog

Previously published on December 16, 2016 in the California Economic Forecast publication.

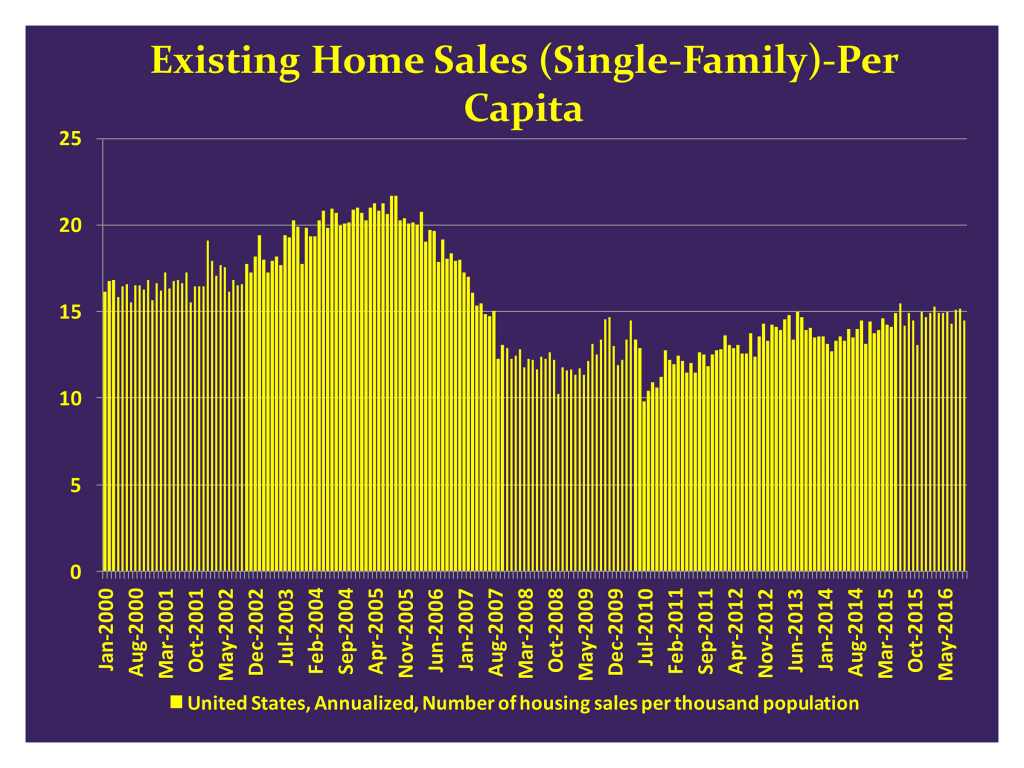

United States housing sales have been climbing since the recession, but are still relatively low. This is particularly true once the home sales are adjusted for population.

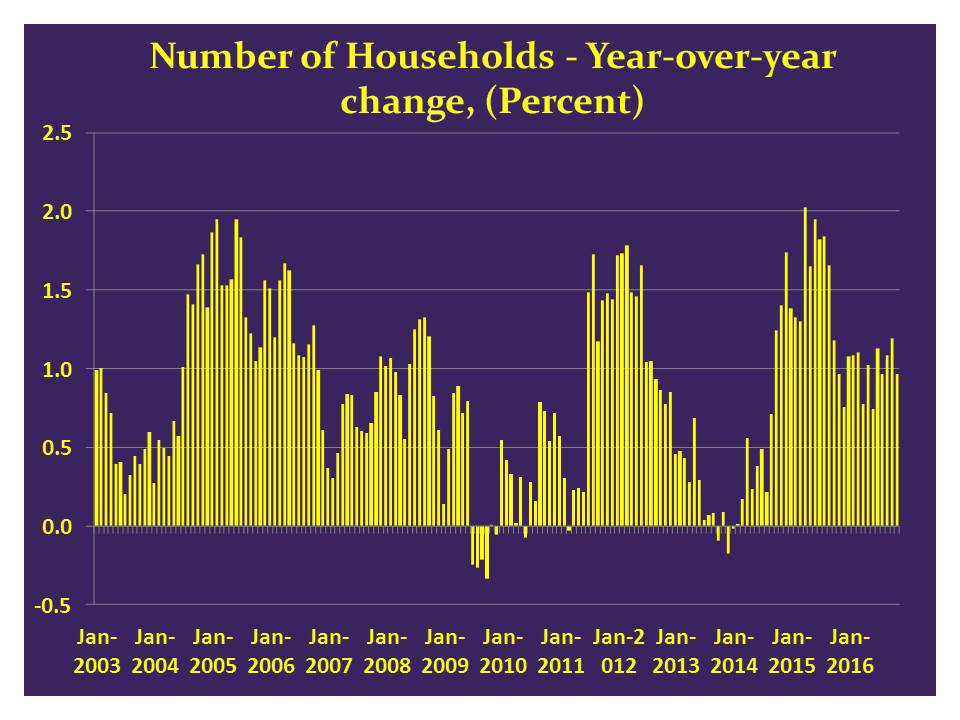

Household formation has shown some signs of life lately, especially since early 2015.

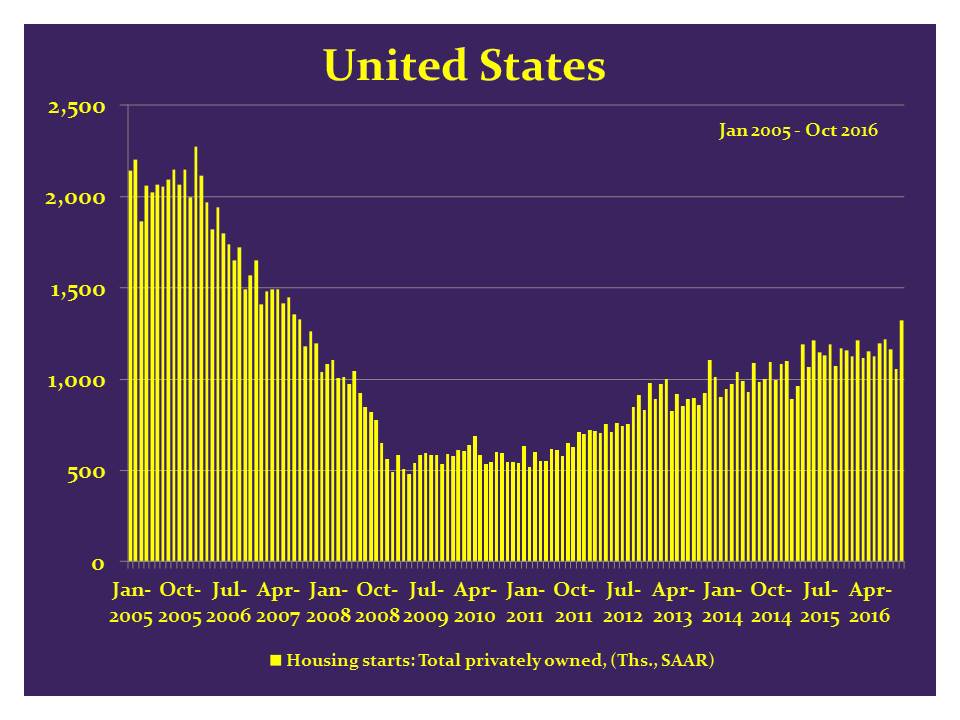

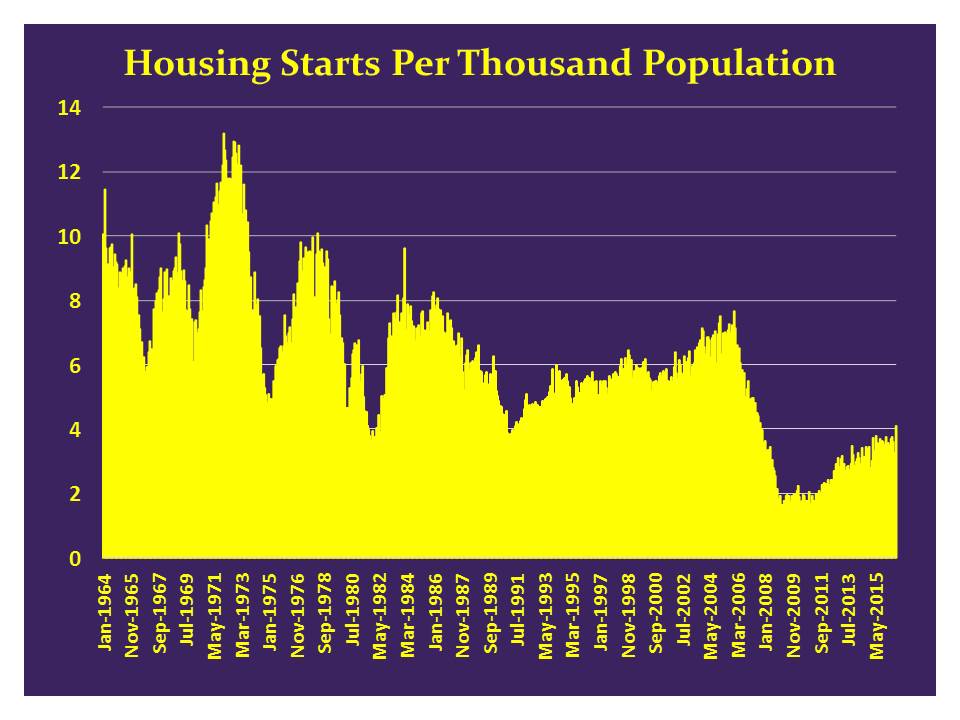

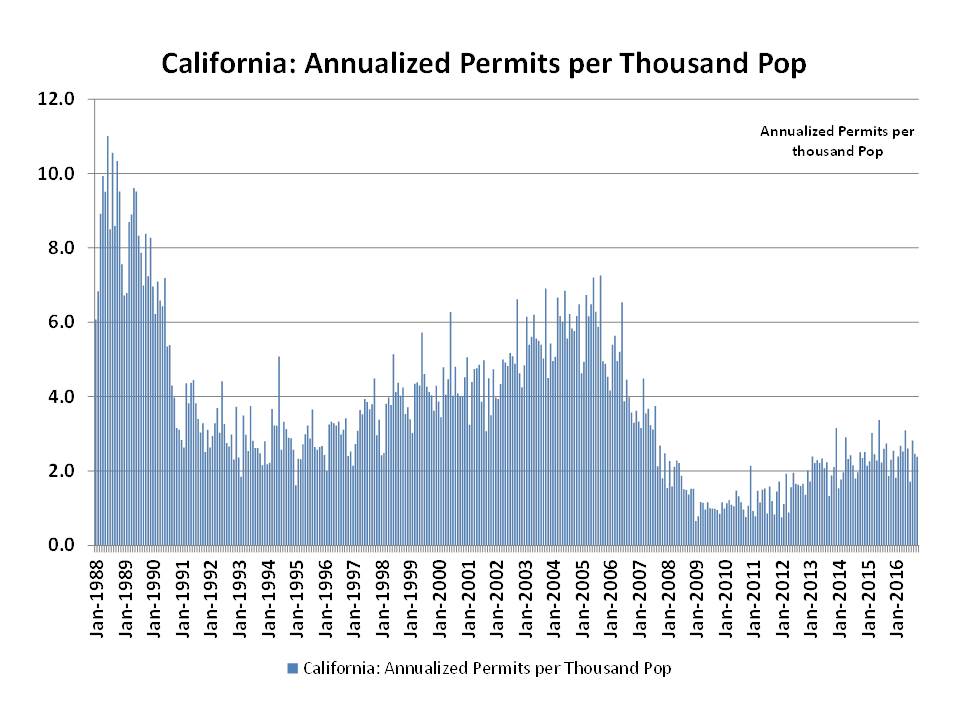

New home starts have recovered from the depths of the recession, however, as a share of the population housing starts are astonishingly low.

In fact, despite economic expansion since 2009, home starts have barely climbed back to a level equal to the lows reached in previous recessions. The relative rate of new home building activity appears to be in a new normal, a particularly low new normal, since the Great Recession.

With the recent surge in household formation, you would think that new home starts would rise with a similar rate of strength. However, they do not appear to be doing so.

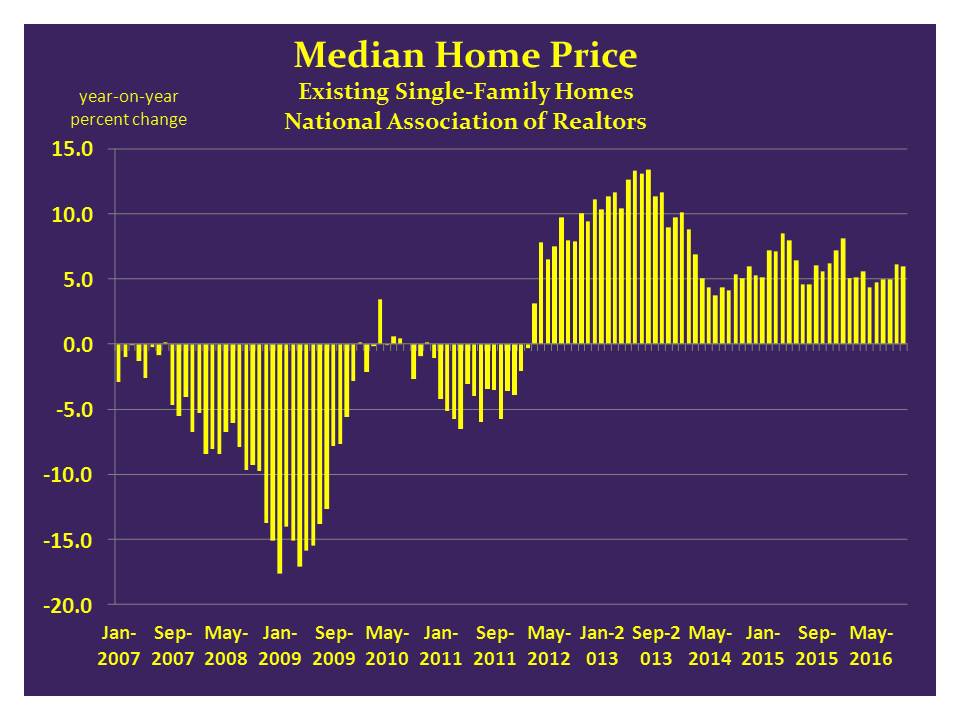

Existing single-family home prices continue to rise at a pretty steady pace of about five percent over the prior year. This is a decent pace, however, it is not due to strong economic and job growth, since neither are strong. It appears to be rising in part due to a supply constraint, the amazingly slow rate of housing construction.

The slow rate of building activity is due in part to policy. Given that land use is controlled locally in most parts of the United States, this is a local policy issue rather than federal. Paperwork, fees, unclear or shifting rules, and delays hamper real estate development, housing as well as non-residential buildings. This is particularly true on the coasts of the country.

This implies that the economy does not benefit from the large multiplier effect that a new house or building brings. In other words, the construction of just one new home requires substantial amounts of wood, glass, and many other materials and products, from other industries. As well, the economy does not benefit from the follow-on spending associated with a new home on furniture, appliances, linens, and many other purchases, many of which are on consumer durables.

Given that many of those purchases that accompany a new home are durables, and given that many of the components used in new home construction are durables, this is a factor that negatively impacts the manufacturing sector in the U.S. Part of a manufacturing development policy would be a robust real estate development policy.

California’s housing market shares most of the above-mentioned characteristics with the U.S. housing market. Home price growth is steady, at a slightly more rapid pace than the U.S. with year-to-date existing single-family home price growth at 6.8 percent. Sales volumes are qualitatively similar.

I noted above that the national new home building rate is extremely low. However, it is high compared with California. California’s rate is only half of the national rate!

While a high building rate is not necessary for a robust economy, it helps. A complete economic development strategy should include housing.