CERF Blog

The commerce department reported today that United States housing starts fell from 659 thousand to 593 thousand from April to May. This was the largest drop in starts since 1991. As well, building permits, which are an indicator of future starts declined to a one-year low.

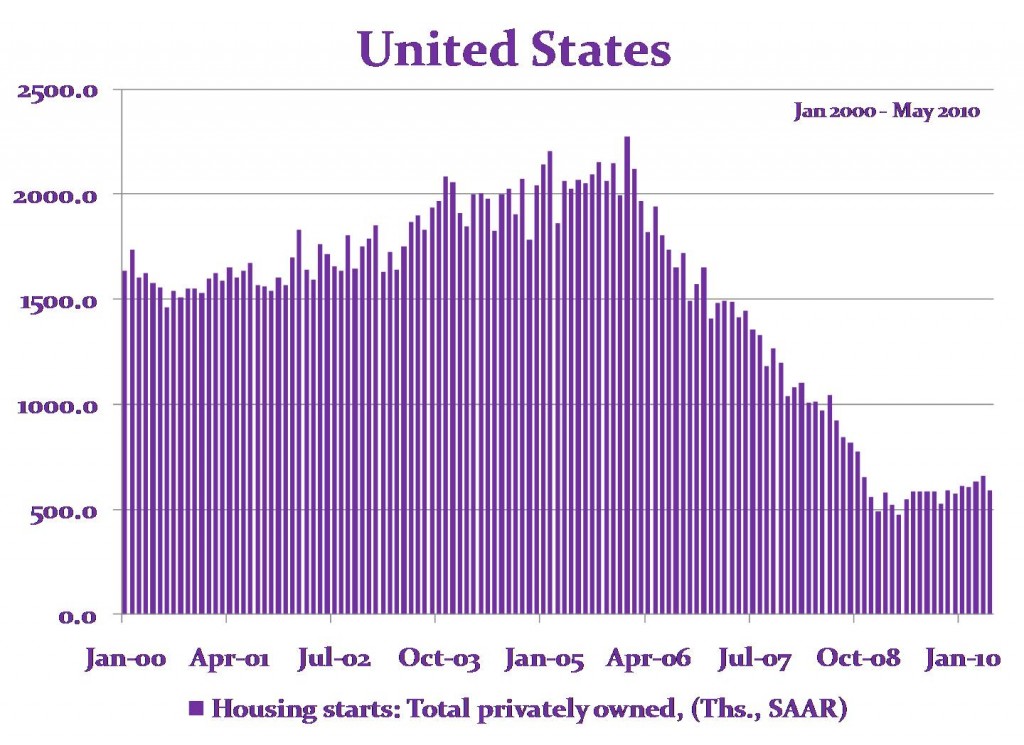

This is bearish news for the United States economy, but I bring something more important to your attention. From the chart below, you can see that in the year 2000 the United States typically experienced housing starts at the one and a half million home annual rate. This was pre-bubble, the bubble-rate during 2005 and 2006 was about 2 million starts. At least as important, the United States economy has been mired in the low housing start level of 500 to 600 thousand since November of 2008 with no sign of breaking out of this regime.

Our United States GDP forecast for each of the remaining quarters in 2010 is approximately 100 basis points below the consensus forecast. This measure of economic activity is partly why our forecast is bearish, other reasons include weakness in the Household sector’s balance sheet, and on-going problems in banking. I ask this question for my competitors, the other forecasters who in the aggregate are the consensus, how could real GDP growth be three percent when housing starts remain this low?