CERF Blog

Previously published in the California Economic Forecast, March 24, 2011

If you are looking for a summary statistic on the United States economy, I recommend you consider bank charge-offs. These are the loans that banks have written off their books, because the probability of collecting them is so low. It doesn’t mean that the borrowers are off the hook, or that the bank will stop trying to collect the loan. It only means that a bank can’t consider a charged-off loan an asset.

Most people use GDP growth as a summary statistic for the economy, which leads to the current situation where policy makers and talking heads have declared a recovery while millions who have been unemployed for months or years continue to be unemployed. Indeed there were two recessions, based on GDP, in the 1960s where all of the job losses occurred after the recession was declared officially over.

OK, so why not use jobs as an indicator of prosperity? Actually, I’m sympathetic to that. It is certainly a better indicator of well being than is GDP. However, I think that charge-offs, particularly now, give us a little more information. Jobs tell us what businesses are doing. Charge-off data tell, at least in some sense, what business can do. That’s because banks don’t lend much when charge-offs are high, and without loans, businesses can’t grow.

So, what are bank charge-off data telling us?

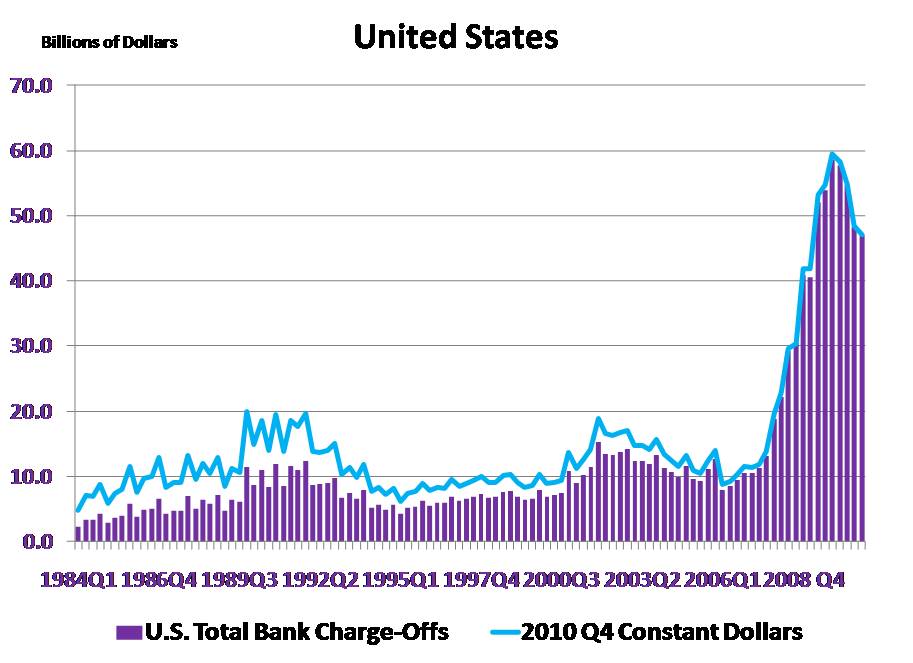

They are telling us that a robust recovery is a ways off. Below is a history of real, inflation adjusted, bank charge-offs:

Prior to 2007, quarterly bank charge-offs had never exceeded $15 billion a quarter in today’s dollars. Then, they skyrocketed to almost $60 billion a quarter. Since then, bank charge-offs have fallen, but they remain well above $40 billion a quarter. You have to conclude that our banking system is still crippled.

This impacts small business much more than it impacts big business. Big businesses have direct access to capital markets and don’t need financial intermediation.

There are more reasons to be bearish on American small business growth. People who own small business own real estate, much more than the typical American. About 98 95 percent of all small business owners own their own home, but only about 66.5 percent of all American households own their own home. This means that small business was disproportionally hurt by the collapse in real estate values. Their balance sheet was suddenly over-leveraged, impairing their willingness and ability to borrow.

The inability of small business to use real estate equity to finance growth has impacts that are exacerbated by a banking sector that has forgotten how to lend to small business without the use of real estate as a secondary repayment source.

It used to be that small business had access to lines of credit secured by inventories or receivables. These were expensive loans, but they did not require real estate equity for the firm to grow, and in cyclical businesses they were self-liquidating, something that bankers just loved.

As real estate values climbed, banks lowered costs by moving away from these loans. Consequently, while some inventory and receivable financing remains, it is less important than it used to be. Perhaps worse, many bankers don’t know how to make and supervise inventory and receivable lines of credit. It was always a specialty. Today, asset-based lending, as this type of lending is referred to, is an almost forgotten specialty.

Still, those banks that are well enough capitalized to be aggressively seeking lending opportunities would be well advised to consider setting up asset-based lending units. It may be the only way for them to significantly increase loan volume in the near term. It would also be a service to small business and the economic well being of all of us.

The other alternative for small business expansion would be for real estate values to suddenly increase. That is not going to happen in this or next year. I go into the reasons more in the Real Estate Essay, but I have another summary statistic for you, Home Ownership Rates.

Home ownership in the United States is generally about 64 percent. That is about 64 percent of households own the home they live in. When the homeownership rate gets much above 64 percent, we have problems in our financial sector. Remember the Savings and Loan Crisis?

The United States homeownership rate climbed during the second half of the 1990s and the first half of the 2000s, until they peaked at over 69 percent. Since then, it has fallen, but not by enough. Until the United States home ownership ratio drops to below 65 percent, there will be no generalized upward pressure for home prices.

I think we have to conclude that this recovery is weak, because the normal drivers of a robust recovery, small business and real estate, can’t contribute.

Updated February 29th to correct data error.